Understanding the Latest CPI Data from New Zealand

Overview

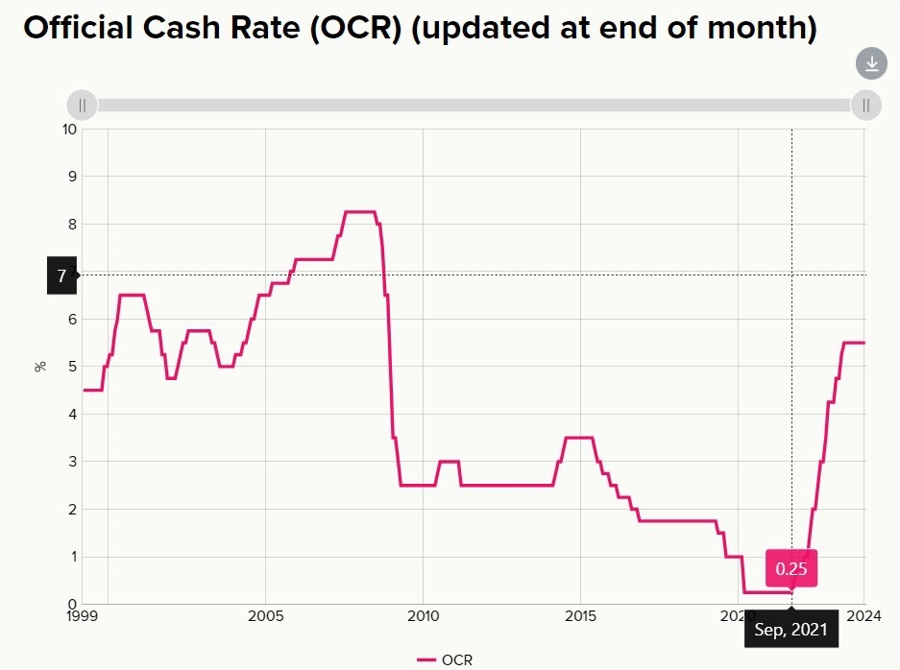

The latest CPI data from New Zealand, released this week, showed a lower inflation rate. However, this decrease can be attributed to the composition of the data, and it is not expected to significantly alter the Reserve Bank of New Zealand’s (RBNZ) inflation outlook. The ongoing tradables disinflation continues to exert downward pressure on headline inflation numbers. To gain confidence that overall inflation is on track to return to the target range, the RBNZ is looking for more progress in non-tradables inflation.

RBNZ’s Q1 Survey of Expectations

Additionally, the RBNZ’s Q1 Survey of Expectations was published this week…

Implications for Individuals

As an individual in New Zealand, the latest CPI data may have various effects on your financial situation. The lower inflation rate could impact the prices of goods and services, influencing your purchasing power and cost of living.

Global Impact

On a global scale, the RBNZ’s approach to managing inflation and economic stability can have ripple effects on the international financial markets, trade relations, and investment decisions.

Conclusion

In conclusion, the latest CPI data from New Zealand indicates a lower inflation rate largely driven by tradables disinflation. Although this may not significantly shift the RBNZ’s inflation outlook, it highlights the importance of monitoring non-tradables inflation for sustained economic recovery.