91 Days of Profit-Taking: A Historical Look at Bitcoin’s Ups and Downs

Quick Take

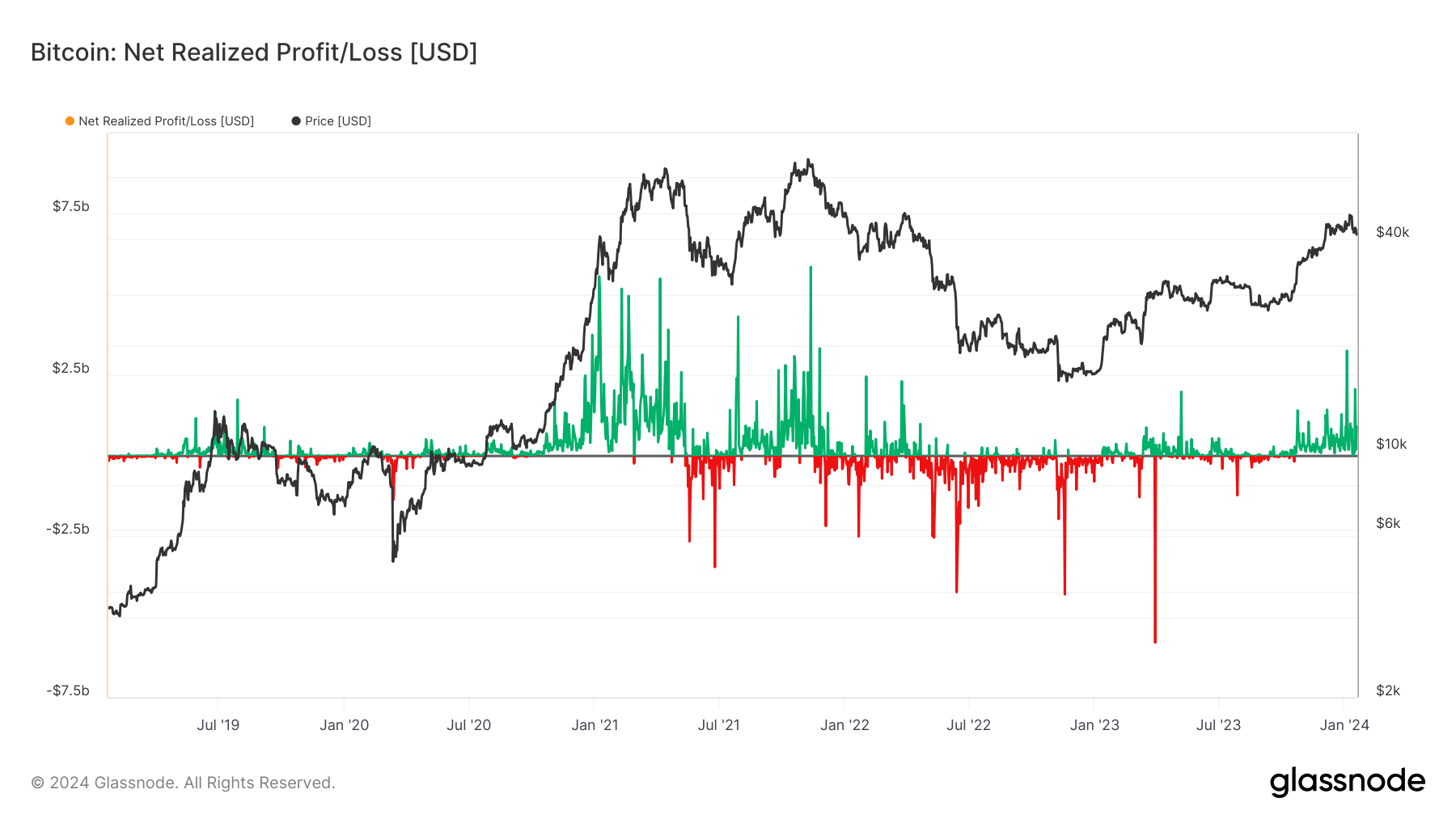

As Bitcoin’s value teeters slightly over $40,000, the market undergoes significant sell pressure, partly attributable to GBTC outflows and an intriguing profit-taking trend. This trend, which CryptoSlate closely monitors, reveals long-term holders and short-term holders engaging in profit-taking at levels not witnessed in years. From Oct. 20, 2023, onwards, daily profit-taking has become a common occurrence in the Bitcoin market.

A Funny Look at Bitcoin’s Rollercoaster Ride

Bitcoin has always been known for its wild price fluctuations, and the past 91 days have been no exception. It’s like riding a rollercoaster, with each sharp drop followed by a thrilling climb. Just when you think you’ve reached the peak, another dip comes along to keep you on your toes.

A Personally Reflective Journey

For many investors, these 91 days have been a time of reflection and decision-making. Should they hold on to their Bitcoin for the long term, or take the opportunity to cash out and secure some profits? It’s a personal journey that each investor must navigate, weighing the risks and rewards of staying in the game.

A Quirky Observation

One quirky observation from this period is the behavior of both long-term holders and short-term traders. While long-term holders typically advocate for holding onto Bitcoin as a store of value, even they can’t resist the temptation to take profits when the price reaches certain levels. On the other hand, short-term traders are constantly looking for opportunities to capitalize on price movements, leading to a constant cycle of buying and selling.

How Will This Affect Me?

As an individual investor, these trends in profit-taking can have a direct impact on your own investment strategy. It’s important to stay informed about market dynamics and be prepared to make decisions based on changing conditions. Whether you choose to hold onto your Bitcoin for the long term or take advantage of short-term profit opportunities, understanding these trends can help you navigate the market more effectively.

How Will This Affect the World?

On a larger scale, the 91 days of historical profit-taking in Bitcoin reflect the evolving nature of the cryptocurrency market. As more investors enter the space and institutional interest grows, we can expect to see increased volatility and trading activity. This can have ripple effects across the global financial system, influencing everything from investment strategies to regulatory policies.

Conclusion

In conclusion, the past 91 days have been a fascinating period in the world of Bitcoin, marked by significant profit-taking and market volatility. Whether you’re a seasoned investor or just starting out, understanding these trends can provide valuable insights into the dynamics of the cryptocurrency market. Stay informed, stay alert, and above all, stay curious about this ever-changing landscape.