Bitcoin’s HODL Waves and Their Implications for Investors

The Rise of Short-term Bitcoin Holders

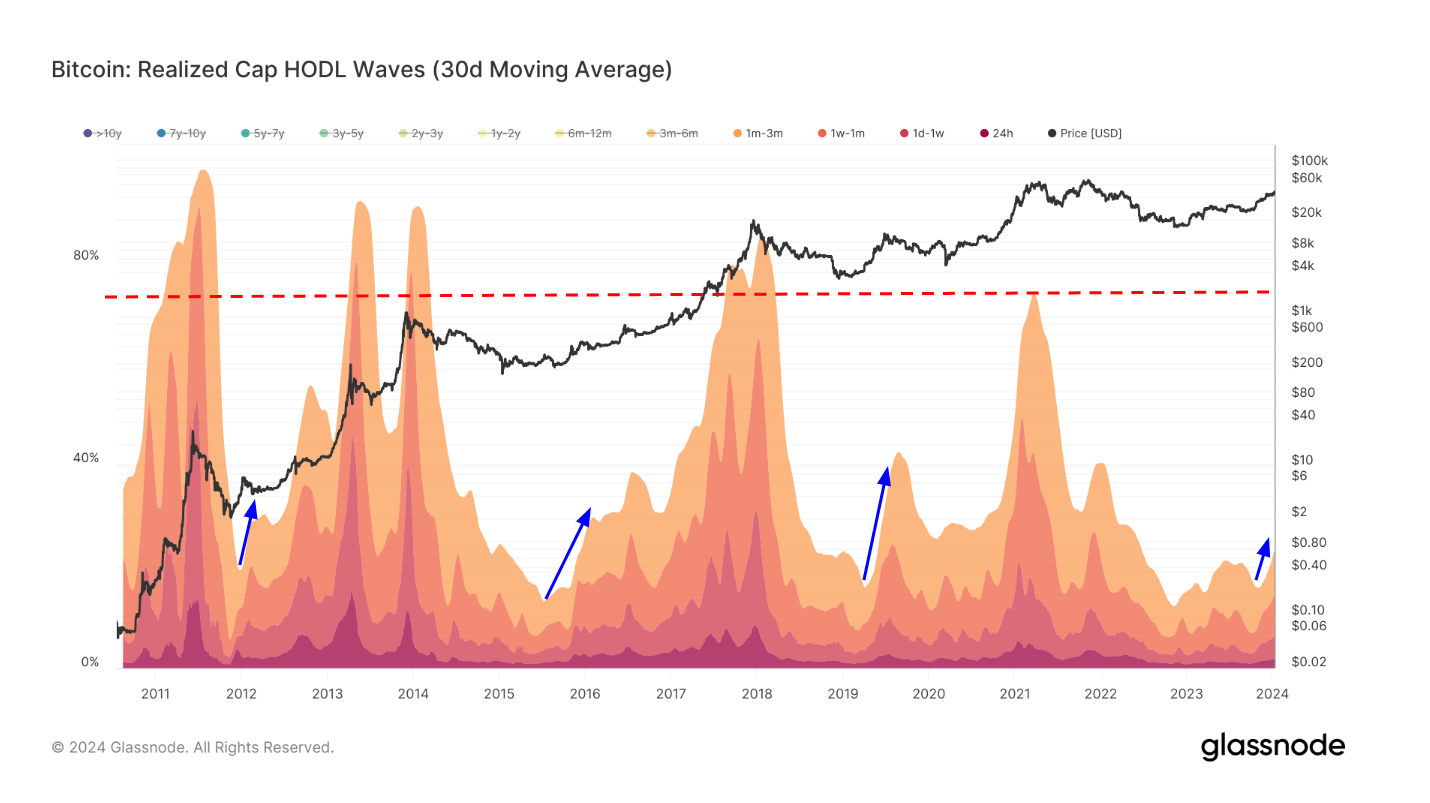

Quick Take: HODL waves, a visual depiction of Bitcoin’s supply based on when it last moved, are revealing a budding cohort in the digital asset domain. Short-term holders, defined as those retaining Bitcoin for a maximum of 155 days, are on the rise. Specifically, investors who have held for three months or less are increasing in number.

Bitcoin’s HODL waves have long been studied by analysts and investors alike as a way to gauge market sentiment and predict potential price movements. The concept is simple: the longer someone holds onto their Bitcoin without moving it, the stronger their conviction in the asset. By categorizing holders based on the length of time they have held Bitcoin, researchers can gain insights into the overall market dynamics.

Signs of FOMO in the Market

The recent trend of increasing short-term holders indicates a growing number of investors who are entering the market with the intent of making quick profits. These individuals are driven by Fear of Missing Out (FOMO) and are more likely to sell their Bitcoin at the first sign of a price spike. As a result, HODL waves are showing a shifting pattern towards shorter holding periods, signaling potential price climbs driven by FOMO-induced buying pressure.

Impact on Individual Investors

For individual investors, the rise of short-term holders in the market means increased volatility and the potential for rapid price movements. While short-term trading can yield quick profits, it also carries a higher risk of loss. Investors should be mindful of market trends and fluctuations, and consider their long-term investment goals before making trading decisions.

Global Implications

On a global scale, the influx of short-term holders in the Bitcoin market could contribute to greater price instability and speculation. As more retail investors enter the space seeking quick gains, the overall market dynamics may become more volatile. Regulators and policymakers will need to monitor the situation closely to ensure market integrity and investor protection.

Conclusion

Bitcoin’s HODL waves and the rise of short-term holders paint a picture of evolving market dynamics and potential price climbs driven by FOMO. Individual investors should exercise caution in light of increased volatility, while global regulators will need to maintain oversight to safeguard market integrity. As the cryptocurrency market continues to mature, understanding and navigating HODL waves will be crucial for investors seeking to navigate the ever-changing landscape of digital assets.