The Impact of Multivariate Core Trend Inflation on the Economy

Introduction

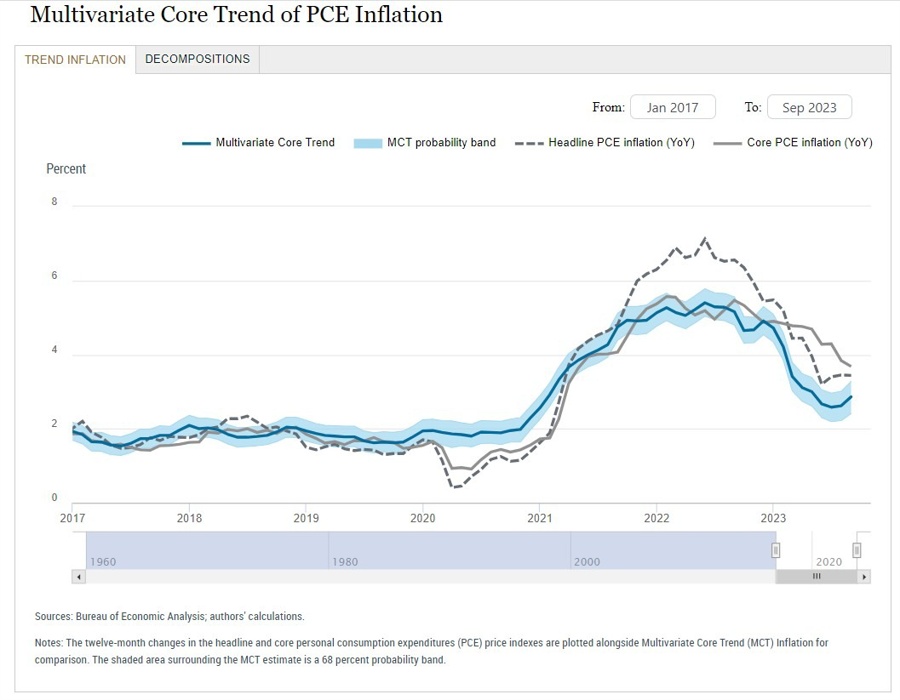

The New York branch of the Federal Reserve recently released its Multivariate Core Trend (MCT) inflation measure, revealing a 2.9 percent inflation rate in September. This marks a 0.3 percentage point increase from August, indicating a potential acceleration in price growth.

Key Findings

The Fed highlighted that the 68 percent probability band for MCT inflation is between 2.4 and 3.3 percent. Services excluding housing played a significant role in the increase, contributing 0.54 percentage points to the MCT estimate compared to pre-pandemic levels.

While the MCT inflation measure is just one of many indicators used by economists, it provides valuable insights into underlying price trends and inflationary pressures within the economy.

How Will This Impact Me?

As a consumer, a higher inflation rate may lead to increased prices for goods and services, potentially reducing your purchasing power. It’s important to monitor inflation trends and adjust your budget accordingly to mitigate any negative impact on your finances.

Global Implications

The increase in inflation rates in the US could have ripple effects on the global economy, impacting trade, investment, and monetary policy decisions in other countries. Central banks around the world may need to adjust their policies in response to changing inflation dynamics, which could impact international markets and exchange rates.

Conclusion

Overall, the release of the MCT inflation measure by the Federal Reserve highlights the importance of monitoring inflation trends and understanding their implications for the economy. As individuals and policymakers navigate these changes, it is crucial to stay informed and adapt to the evolving economic landscape.