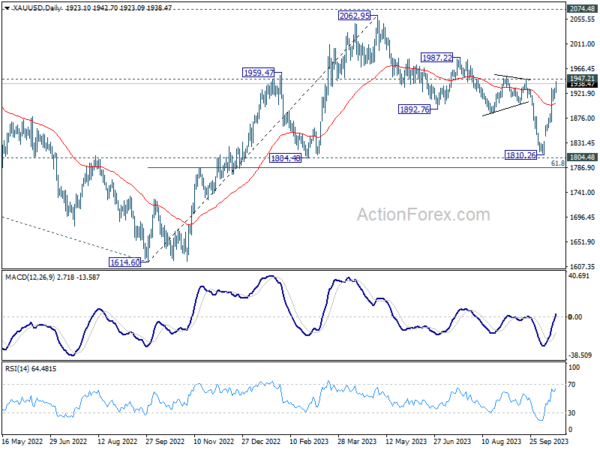

Market Update: Gold and Oil Prices Soar as Middle East Tensions Intensify

Description

The Middle East sees a re-escalation in geopolitical tensions following a tragic strike on a Gaza hospital, leading to a significant rise in both Oil and Gold prices. The effect of this development extends into the Asian session. However, risk aversion is not starkly evident in other markets, as Asian indices, excluding Japan, record only marginal losses. […] The post Gold and Oil Prices Rise Amidst Re-escalating Middle East Tensions appeared first on Action Forex…

How This Will Affect Me

The soaring prices of Gold and Oil due to escalating tensions in the Middle East will have a direct impact on me as a consumer. The increase in Oil prices will likely lead to higher gas prices at the pump, making it more expensive for me to drive and travel. Additionally, the rise in Gold prices may affect the cost of jewelry and other luxury items that contain gold, potentially leading to higher prices for these products.

How This Will Affect the World

The escalation of tensions in the Middle East and the resulting increase in Gold and Oil prices will have a global impact on the economy. Higher Oil prices could lead to higher manufacturing and transportation costs, affecting businesses and consumers around the world. The rise in Gold prices may also affect global trade and financial markets, as investors turn to Gold as a safe-haven asset during times of uncertainty.

Conclusion

In conclusion, the recent spike in Gold and Oil prices due to escalating tensions in the Middle East is a cause for concern both at the individual and global level. As consumers, we may face higher costs for everyday goods and services, while the global economy could experience disruptions in trade and financial markets. It is important to closely monitor the situation in the Middle East and its impact on commodity prices in order to make informed decisions in the face of growing geopolitical uncertainty.