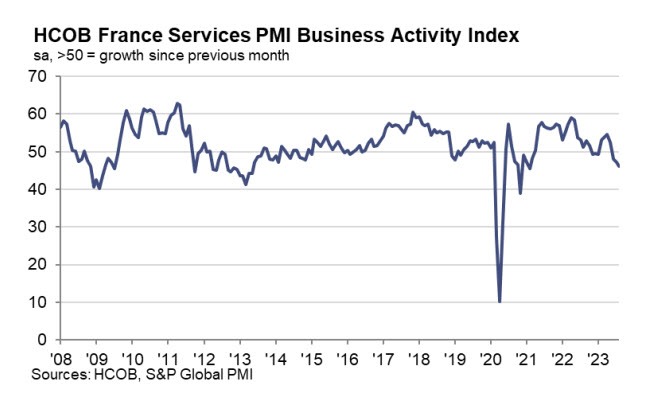

France’s Economic Contraction Deepens in Q3

Prior 47.1Composite PMI 46.0 vs 46.6 prelim

Prior 46.6

The downward revisions just paint a worse picture of France’s economic contraction in Q3, with the services sector seeing its sharpest fall in two-and-a-half years. New orders are seen falling for a fourth month straight but at least input cost inflation is seen easing to a two-year low. HCOB notes that:

“The French services sector remains under pressure in August. The trend is a trifecta of obstacles: a third consecutive month of dwindling business activity, ongoing new order contractions, and job shedding across the sector. The pace of decline in the demand for business services was the fastest for 30 months, while manufacturers cut staffing at the joint-fastest rate for over two years.”

How will this affect me?

The deepening economic contraction in France may have various repercussions on individuals. With job shedding and declining business activity, there may be increased competition for available job positions. Additionally, a slowdown in economic growth could lead to higher prices for goods and services, potentially impacting consumers’ purchasing power.

How will this affect the world?

France is a major player in the global economy, and a significant downturn in its economic performance could have ripple effects worldwide. A weakened French economy could lead to decreased demand for imports, affecting trading partners. Furthermore, investors may become more cautious in light of the economic uncertainties, potentially leading to volatility in financial markets globally.

Conclusion

In conclusion, the deepening economic contraction in France poses challenges both domestically and internationally. It is essential for policymakers to address the underlying issues contributing to this downturn and implement measures to support economic growth and stability. As individuals, it is important to stay informed and adapt to potential changes in the economic landscape to mitigate any adverse effects on personal finances.