USDCHF Incomplete Sequence Favors More Downside in USDX

The USDCHF Swing Sequence

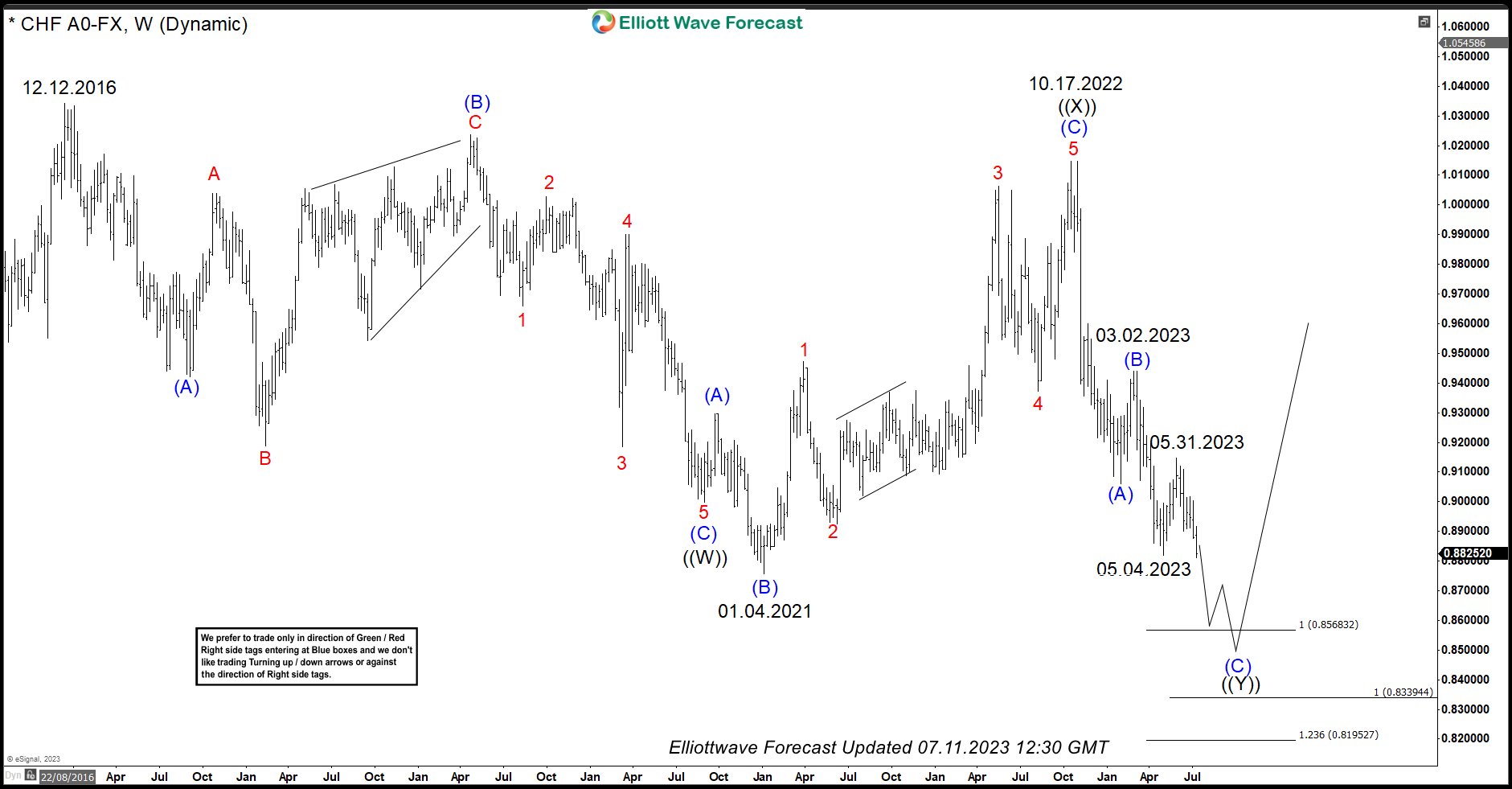

In today’s blog post, we will be diving into the USDCHF swing sequence down from December 2016 peak and from October 2022 peak. Despite the pair not breaking below the January 2021 low, there is already a double incomplete sequence down from the October 2022 peak and also from the March 2023 peak.

Analyzing the Market Trends

Looking at the current market trends, it seems that the USDCHF pair is favoring more downside in the USDX. The incomplete sequences suggest a bearish outlook for the pair, indicating a potential decline in the near future.

Traders and investors should keep a close eye on these developments to make informed decisions regarding their positions in the USDCHF pair.

How This Will Affect Me

As an individual trader, this incomplete sequence in the USDCHF pair may have implications for your trading strategy. It is important to consider the bearish outlook and adjust your positions accordingly to mitigate potential risks.

How This Will Affect the World

On a larger scale, the USDCHF incomplete sequence favoring more downside in the USDX could have ripple effects on the global economy. It may impact currency exchange rates, trade decisions, and overall market sentiment.

Conclusion

Overall, the USDCHF swing sequence down from the December 2016 peak and from the October 2022 peak suggests a bearish outlook for the pair. Traders and investors should closely monitor these developments and adjust their strategies accordingly to navigate the changing market conditions effectively.