Asian Markets Lifted by Positive BoJ Tankan Survey, Overlook Weak Chinese Manufacturing Data

Rising Nikkei Index Boosts Market Sentiment

Asian markets kicked off the trading week on a positive note, with Japan’s Nikkei index leading the gains. The upbeat mood was largely driven by encouraging results from the Bank of Japan (BoJ) Tankan Survey, which provided a much-needed boost to investor confidence. The survey showed an improvement in business sentiment, indicating a possible economic recovery in the near future.

Overlooking Weak Data from China

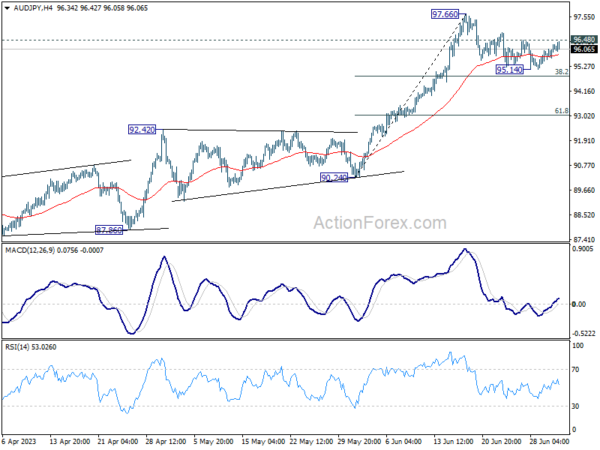

Despite weak data coming from China’s manufacturing sector, with the Purchasing Managers’ Index (PMI) falling below expectations, market participants seemed to focus more on the positive news coming out of Japan. This decision to overlook the weak Chinese data helped to fuel the rally in Asian markets, with the Australian and New Zealand dollars leading the way in terms of currency gains.

Market Impact

As Asian markets continue to react positively to the BoJ Tankan Survey results, investors are hopeful that this trend will continue in the days ahead. The optimism surrounding a potential economic recovery in Japan is providing a much-needed boost to the region’s markets, which have been grappling with uncertainty due to the ongoing global pandemic.

How This Will Impact Me

As an individual investor, the positive momentum in Asian markets could present new opportunities for potential investments. It is important to stay informed and keep a close eye on market developments to capitalize on any potential gains in the coming days.

Global Implications

The positive performance of Asian markets could have a ripple effect on global markets, as investor sentiment improves and confidence returns to the financial markets. This could help to bolster the overall global economy and provide a much-needed boost to various sectors that have been struggling in the wake of the pandemic.

Conclusion

Overall, the positive response to the BoJ Tankan Survey results in Asian markets is a promising sign of potential economic recovery on the horizon. Despite the weak data coming from China, investors are choosing to focus on the bright spots in the region, which is leading to a rally in market sentiment. It will be interesting to see how this trend unfolds in the days and weeks ahead, and the potential impact it could have on both individual investors and the global economy.