The Impact of Large Expiries on EUR/USD

Introduction

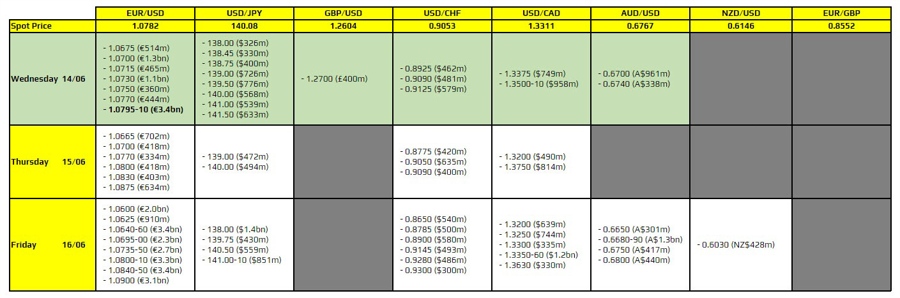

What to Watch Out For Today

There is just one thing to take note of for the day, as highlighted in bold. That being a set of large expiries for EUR/USD just around the 1.0800 handle. That will act alongside the 100-day moving average, seen at 1.0803 currently, to keep a lid on price action all before we get to the Fed later in the day. But once again, after digesting the post-Fed reaction, do be reminded that there are a host of large option expiries still to follow on Friday. It’s quadruple witching time~

For more information on how these expiries can impact trading and market sentiment, continue reading below.

How will this impact me?

As an individual trader or investor, these large expiries for EUR/USD can have a significant impact on your trading decisions. The presence of these expiries around the 1.0800 handle can act as a key resistance level, influencing price action and potentially limiting upside movement. It is important to consider these expiries when planning your trades and setting stop-loss levels to navigate the market more effectively.

How will this impact the world?

On a broader scale, the large expiries for EUR/USD can also affect the global forex market and overall sentiment towards the euro. The 100-day moving average and option expiries around 1.0800 will play a crucial role in shaping market trends and investor confidence. Traders around the world will be closely monitoring these levels and adjusting their strategies accordingly, which could lead to increased volatility and trading activity in the forex market.

Conclusion

In conclusion, the presence of large expiries for EUR/USD around the 1.0800 handle is a key factor to watch in today’s trading session. These expiries, combined with the 100-day moving average, are likely to influence price action and market dynamics leading up to the Fed announcement. As traders and investors, it is important to stay informed about these levels and consider their impact on trading decisions to navigate the market effectively.