The Disparity Between Rising Commercial Property Assessments and Declining Green Street Commercial Property Price Index®

AUSTIN, TEXAS, UNITED STATES, April 21, 2023/EINPresswire.com/ —

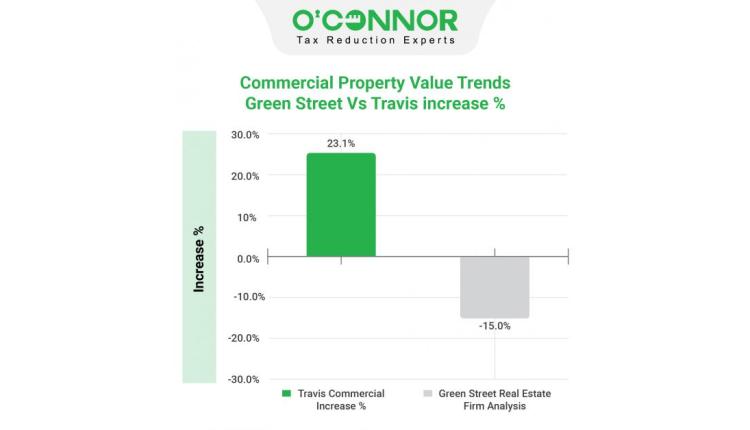

Travis County assessment increases are not limited to single-family homes. Commercial property assessments have also seen staggering increases.

According to the Green Street Commercial Property Price Index, published April…

As property assessments in Travis County continue to rise, many property owners are feeling the strain of increased taxes and operating costs. The disparity between rising assessments and declining property values, as indicated by the Green Street Commercial Property Price Index, is a cause for concern for both local businesses and investors.

Commercial property owners in Austin, Texas, are faced with the challenge of navigating a changing real estate market while also grappling with the financial implications of higher property assessments. The Green Street Commercial Property Price Index, which measures the performance of commercial properties in major markets across the United States, has shown a decline in property values in recent months. This decline is in stark contrast to the rising assessments that property owners are receiving.

For local businesses, the increase in property assessments means higher operating costs, which can have a direct impact on their bottom line. As property values continue to decline, businesses may find themselves paying more in property taxes relative to the actual value of their property. This can put a strain on businesses, particularly small and medium-sized enterprises that may already be operating on tight margins.

For investors in commercial real estate, the disparity between rising assessments and declining property values presents a unique challenge. Investors may find themselves holding properties that are assessed at a higher value than what they could realistically sell for on the open market. This can limit their ability to leverage their investments and may lead to financial losses in the long run.

Overall, the disparity between rising commercial property assessments and declining property values is a complex issue that has wide-reaching implications for the local real estate market in Austin, Texas. Property owners, businesses, and investors will need to carefully navigate these challenges in order to protect their interests and secure their financial future.

How This Will Affect Me

As a local business owner in Austin, Texas, the disparity between rising commercial property assessments and declining property values will likely have a direct impact on my bottom line. The increase in property assessments means higher operating costs, which could eat into my profits and limit my ability to grow my business. I will need to carefully budget and plan for these increased expenses in order to ensure the long-term sustainability of my business.

How This Will Affect the World

The disparity between rising commercial property assessments and declining property values in Austin, Texas, is indicative of larger trends in the global real estate market. As property values fluctuate and assessments continue to rise, investors around the world may find themselves facing similar challenges in managing their real estate portfolios. This disparity highlights the importance of careful financial planning and risk management in the volatile world of commercial real estate.

Conclusion

The disparity between rising commercial property assessments and declining property values in Austin, Texas, is a complex issue with wide-ranging implications for property owners, businesses, and investors. As property assessments continue to rise, stakeholders will need to carefully navigate these challenges in order to protect their interests and secure their financial future. By staying informed and proactive, it is possible to weather the storm of changing real estate market conditions and emerge stronger on the other side.