Market Analysis: USD Breaking to the Upside

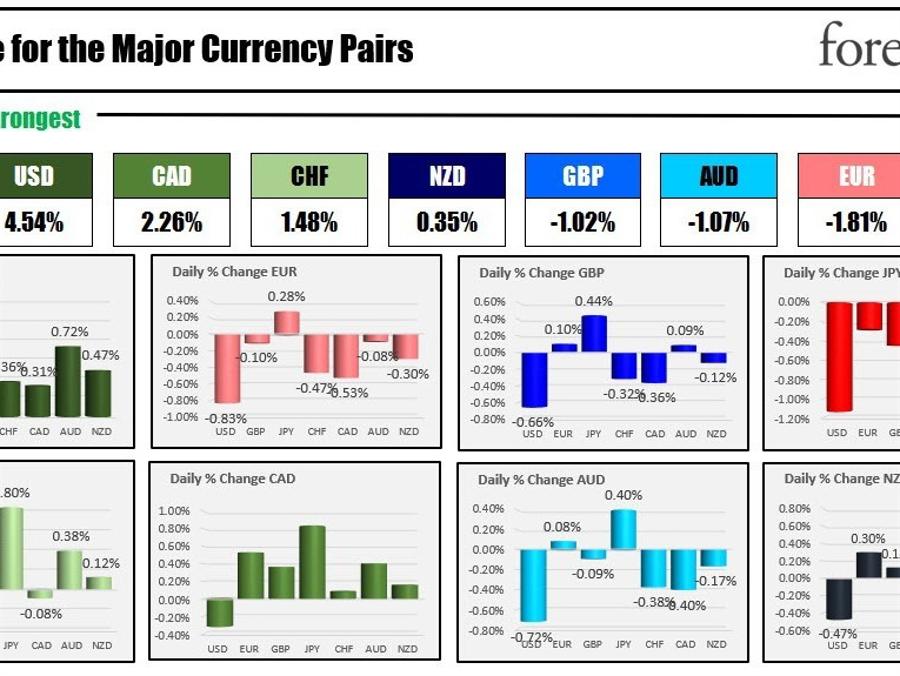

The USD is breaking to the upside today with the greenback benefitting from risk aversion as investors are increasingly concerned about a China slowdown due to the recent Covid surge. Technically, the USD is moving through key technical levels. The EURUSD fell below the 200 hour MA on the downside and below a short term retracement target as well. The USDJPY moved above its 100 day MA and 200 hour MA after using the 100 day MA as a ceiling level last week.

Market analysts are closely watching the movement of the USD as it breaks to the upside amidst growing concerns about a slowdown in China. The recent surge in Covid cases in the country has reignited fears of economic instability, prompting investors to turn to the safe-haven of the greenback.

Technically, the USD has been making significant moves through key technical levels. The EURUSD, for example, fell below the 200 hour MA and a short term retracement target, signaling a bearish trend in the pair. Similarly, the USDJPY saw a breakthrough as it moved above its 100 day MA and 200 hour MA, overcoming previous resistance levels.

Impact on Me

As a trader or investor, the upward movement of the USD could have implications for your investment portfolio. It may be wise to reassess your positions and consider hedging against potential volatility in the markets.

Impact on the World

The strengthening of the USD could have a ripple effect on the global economy, particularly for countries heavily reliant on exports. A stronger dollar may lead to a decrease in demand for goods and services from these nations, impacting their economic growth.

Conclusion

In conclusion, the USD’s breakout to the upside reflects the current market sentiment driven by concerns over a China slowdown. As traders and investors, it is important to stay informed and adapt to the changing landscape to mitigate risks and seize opportunities in the financial markets.