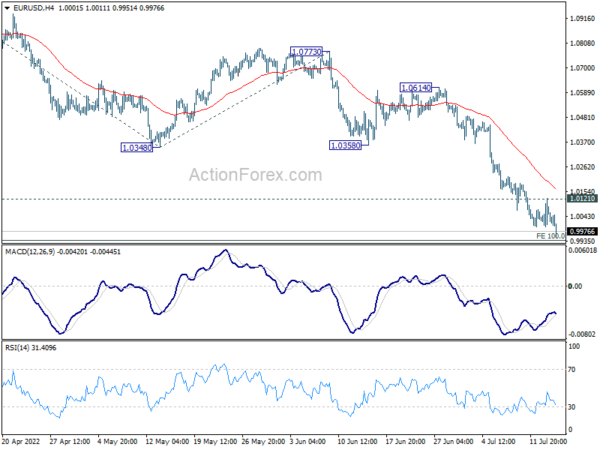

Daily Pivots: (S1) 1.0000; (P) 1.0037; (R1) 1.0074; More…

EUR/USD’s fall continues today and intraday bias stays on the downside.

Firm break of 100% Fibonacci extension of 1.2555 to 1.1119, might target 138.2% projection of 1.2555 to 1.1186 from 1.1412 at 1.1031. Sustained break there will pave the way to 161.8% projection at 1.0857.

This downward trend in EUR/USD is a significant development in the forex market. Traders and investors are closely watching the movement of this currency pair as it can have a ripple effect on other major currencies and global economies.

Factors such as economic data releases, geopolitical events, and central bank policies can all contribute to the rise or fall of currency exchange rates. It is important for traders to stay informed and adapt their strategies accordingly to navigate through volatile market conditions.

How will this affect me?

If you are involved in forex trading or international business, the downward trend in EUR/USD could impact your portfolio or transactions. It is essential to monitor market trends, manage risks effectively, and seek professional advice to make informed decisions.

How will this affect the world?

The movement of major currency pairs like EUR/USD can have a wide-reaching impact on global trade, investments, and economic stability. Fluctuations in exchange rates can influence export/import prices, foreign investments, and overall market sentiment, affecting various industries and economies worldwide.

Conclusion:

In conclusion, the continued fall of EUR/USD highlights the dynamic nature of the forex market and the interconnectedness of global economies. It is crucial for market participants to stay vigilant, adapt to changing conditions, and make informed decisions to navigate through uncertain times.