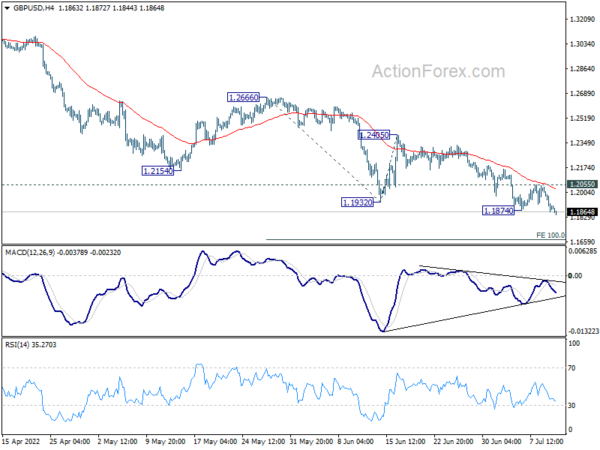

Daily Pivots: (S1) 1.1827; (P) 1.1932; (R1) 1.1998; More…

GBP/USD’s Rollercoaster Ride

Hey there, fellow traders! Today, we’re diving into the world of daily pivots and exploring how they can impact our trading strategies. So, buckle up and get ready for a wild ride!

The Story So Far

GBP/USD’s down trend has resumed after a brief period of consolidations. The intraday bias is back on the downside, leaving traders on their toes and wondering what will happen next.

As we look at the daily pivots – with levels at 1.1827 (S1), 1.1932 (P), and 1.1998 (R1) – we can see the potential for some interesting price action in the days to come. Will the trend continue downward, or will we see a reversal and a rise in the exchange rate? Only time will tell!

How This Affects You

For individual traders like you and me, this daily pivot data can be crucial in determining our next move. Whether you’re a day trader looking to capitalize on short-term fluctuations or a long-term investor planning your next big trade, understanding and utilizing pivot points can give you an edge in the market.

How This Affects the World

On a larger scale, fluctuations in the GBP/USD exchange rate can have a ripple effect on global economies. As one of the most traded currency pairs in the world, any significant changes can impact international trade, investments, and economic policies. So, even if you’re not directly involved in forex trading, the outcome of GBP/USD’s rollercoaster ride could still have far-reaching consequences.

Conclusion

So, there you have it – a glimpse into the world of daily pivots and their potential impact on both your personal trading strategies and the global economy. Whether you’re a seasoned trader or just starting out, keeping an eye on these pivot points could make all the difference in your success. So, stay informed, stay nimble, and happy trading!