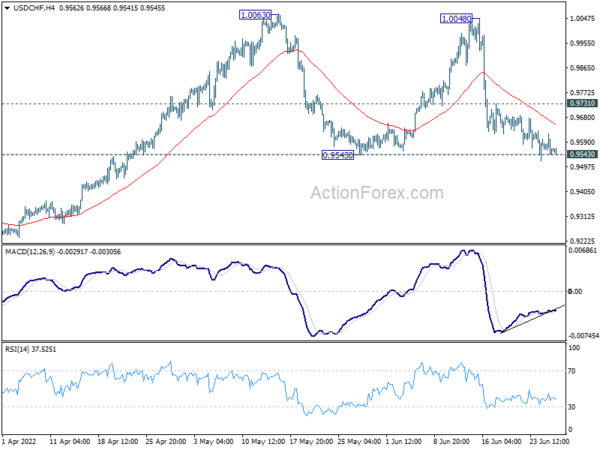

Daily Pivots: (S1) 0.9531; (P) 0.9575; (R1) 0.9608; More…

Intraday bias in USD/CHF stays neutral first.

Fall from 1.0048 is still seen as the third leg of the corrective pattern from 1.0237. Intraday bias in USD/CHF is set at neutral first. A few support levels stand at 0.9484. and a solid support layer at 38.2% retracement from 0.9186 to 1.0237 at .9956. However, a caveat also comes with resistance at 0.9670 to break first. On the upside, a decent rise could be witnessed after 0.9670 level.

How Will This Affect Me?

This data is important for traders and investors who are involved in the foreign exchange market. It provides valuable information regarding the daily pivots for the USD/CHF currency pair, which can help them make informed decisions about their trades. Traders can use this data to set their stop-loss levels, profit targets, and make predictions about the future movement of the currency pair.

How Will This Affect the World?

The movement of the USD/CHF currency pair is influenced by various factors such as economic data, geopolitical events, and market sentiment. A neutral bias in the intraday trading of this currency pair could indicate uncertainty in the market. This could have ripple effects on other currency pairs and global financial markets, potentially leading to increased volatility and fluctuations in exchange rates.

Conclusion

In conclusion, the neutral intraday bias in USD/CHF provides valuable insights for traders and investors in the foreign exchange market. It is important to closely monitor the daily pivots and technical levels to make informed decisions about trading the currency pair. Additionally, the impact of this data on the world economy and financial markets should not be underestimated, as it could signal potential shifts in market sentiment and volatility.