Daily Pivots and EUR/JPY Outlook

Introduction

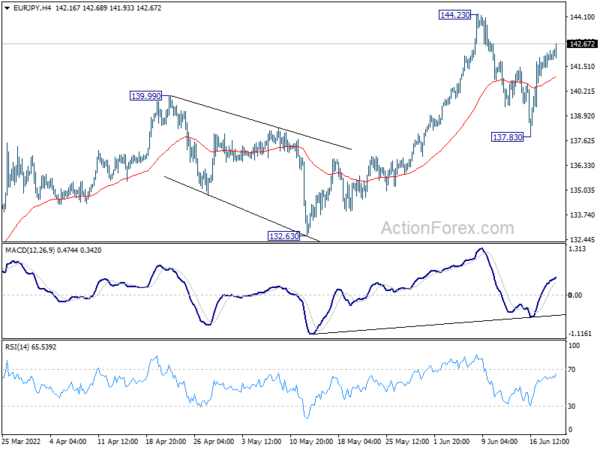

Today we are going to delve into the daily pivots for EUR/JPY, which are currently at (S1) 141.45, (P) 141.91, and (R1) 142.45. The intraday bias remains on the upside for retesting 144.23 high. Let’s take a closer look at what this means for traders and investors.

Analysis

EUR/JPY has been exhibiting a bullish trend, with the daily pivots pointing towards a potential uptrend. The pivot point at 141.91 acts as a crucial level to watch, as a break above this level could indicate further gains towards the resistance level at 142.45. Traders should keep a close eye on these levels for potential trading opportunities.

Implications for Traders

For traders in the EUR/JPY market, the current outlook suggests a bullish bias with potential for retesting the previous high at 144.23. This could present opportunities for long positions with proper risk management strategies in place. It is important to monitor price action and key levels to make informed trading decisions.

Effect on Individuals

For individual traders and investors, the bullish outlook for EUR/JPY could mean potential profit opportunities in the forex market. By staying informed and analyzing market trends, individuals can capitalize on the current market conditions to make strategic trading decisions.

Global Impact

In the broader context, the outlook for EUR/JPY can have ripple effects on the global economy. A strong performance in the euro against the Japanese yen could impact international trade, investment flows, and overall market sentiment. Traders and policymakers around the world will be monitoring these developments closely.

Conclusion

Overall, the daily pivots for EUR/JPY and the bullish outlook signal potential opportunities for traders and investors. By staying informed and monitoring key levels, individuals can make informed decisions in the forex market. The global impact of these market dynamics underscores the interconnected nature of the financial markets.