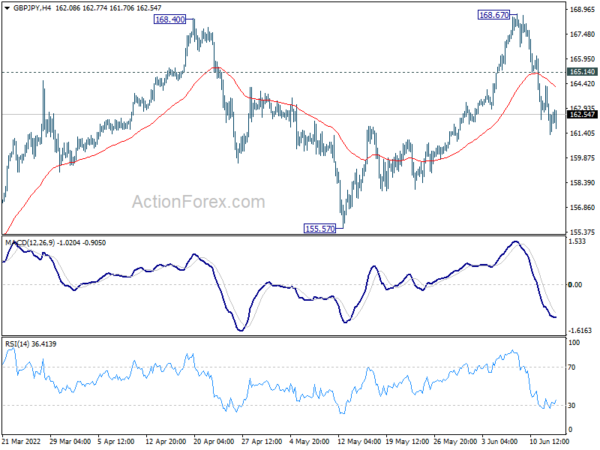

Daily Pivots: (S1) 161.10; (P) 162.71; (R1) 164.09; More…

GBP/JPY’s Intraday Bias

GBP/JPY’s fall from 168.67 is still in progress and intraday bias stays on the downside. The currency pair is currently trading around the pivot point of 162.71, with support at 161.10 and resistance at 164.09. Traders are closely watching the developments in the forex market to gauge the next move.

Market Analysis

With the ongoing fall in GBP/JPY, traders are advised to be cautious and monitor the key support levels. The currency pair’s performance is influenced by various factors including economic data, market sentiment, and geopolitical events. It is important to stay informed and analyze the market trends before making any trading decisions.

Impact on Individuals

For individual traders involved in GBP/JPY, the current downtrend could result in potential losses if proper risk management strategies are not implemented. It is crucial to closely monitor the market conditions and adapt trading strategies accordingly to mitigate risks and capitalize on opportunities.

Global Implications

The performance of GBP/JPY has broader implications on the global forex market. As one of the major currency pairs, fluctuations in GBP/JPY can impact international trade, economic policies, and financial markets worldwide. Traders and investors around the globe are closely watching the developments in GBP/JPY to assess the overall market sentiment and make informed decisions.

Conclusion

In conclusion, the ongoing fall in GBP/JPY has significant implications for traders and the global forex market. It is essential for individuals to stay informed, remain adaptable, and implement effective risk management strategies to navigate the current market conditions successfully.