Charmingly Eccentric and Engaging: A Look at Daily Pivots

The Daily Pivots Overview

In the world of trading and finance, keeping track of daily pivots is vital for making informed decisions. These pivots provide key levels that help traders identify potential support and resistance areas.

US/CHF’s Recent Movement

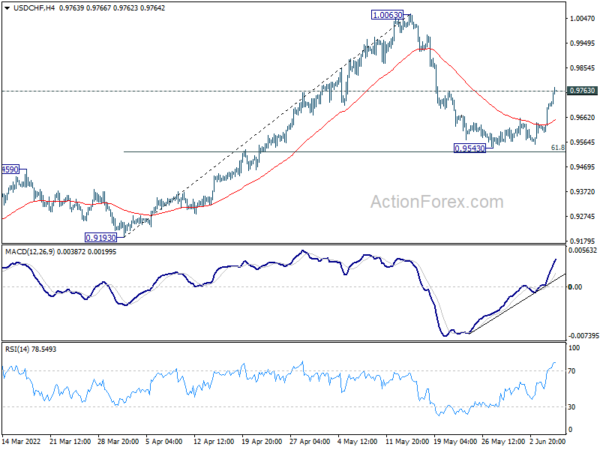

The recent breach of 0.9763 minor resistance by US/CHF suggests a possible completion of the pullback from 1.0063. This movement indicates a potential shift in the market dynamics for this currency pair.

Traders and investors will need to closely monitor the price action following this breach to determine the next steps in their trading strategies. Understanding the implications of this movement can help them capitalize on potential opportunities or navigate potential risks in the market.

How This Will Affect You

As an individual trader or investor, the breach of 0.9763 minor resistance by US/CHF could impact your trading decisions. It is essential to stay informed about the latest market developments and analyze how they may affect your portfolio. Consider consulting with a financial advisor or conducting thorough research to make well-informed decisions.

How This Will Affect the World

The movement in US/CHF and other currency pairs can have broader implications for the global economy. Shifts in currency values can impact international trade, inflation rates, and overall economic stability. It is crucial for policymakers and financial institutions to monitor these developments and adjust their strategies accordingly to mitigate potential risks.

Conclusion

In conclusion, daily pivots such as the recent breach of 0.9763 minor resistance by US/CHF signify important shifts in the market. Traders and investors must stay vigilant and adapt their strategies accordingly to navigate the ever-changing landscape of financial markets.