Forex News

EUR/JPY Daily Outlook: Professional, Educated, and Profit-Focused Analysis

Daily Pivots: (S1) 141.80; (P) 142.28; (R1) 143.17; More… EUR/JPY Intraday Bias Neutral Stance EUR/JPY is showing a neutral stance in its intraday bias at this moment. There hasn’t been a definitive move in either direction, with the pivot point holding steady at 142.28. Traders are waiting for a decisive break above the resistance level…

Get Ready to Trade Like a Pro: Your Weekly Dose of Chart-tastic Fun for June 27th, 2022!

The last trading week of the month Time to step up our game! Let’s make those last-minute profits! Hey traders! It’s that time again – the last trading week of the month. Time to roll up our sleeves and get ready to make some moves to secure those profits. I don’t know about you, but…

Unlocking the Secrets of Day Trading for a Lucrative Living: Essential Tips and Tricks

Subscribe Apple | Google | Spotify | Stitcher | Soundcloud | YouTube Introduction I know that you’re thinking: “If I were a day trader, I’ll definitely be that…” Exploring the World of Day Trading Day trading is a popular form of trading that involves buying and selling financial instruments within the same trading day. Many…

Unlocking the Potential: How to Profit from the Yen’s Decline in CHF/JPY Trading

CHFJPY – Taking Advantage of Weakening Yen Last week, the market saw a surge in CHFJPY like never before. For the first time since 2007, the Swiss National Bank (SNB) made a bold move by increasing their interest rate by 50 basis points. This decision came right after the Federal Reserve (FED) raised their interest…

Unlocking the Secrets of USDNOK: A Closer Look at the Dollar’s Response to the Blue Box

USDNOK – Dollar Sees a Reaction from Blue Box We have been pretty bullish on the USDNOK throughout the year and Dollar has more strength to come to support this pair. Recently, we posted a trade idea on USDNOK that the market was correcting in a 3 or 7 swing structure and we took advantage…

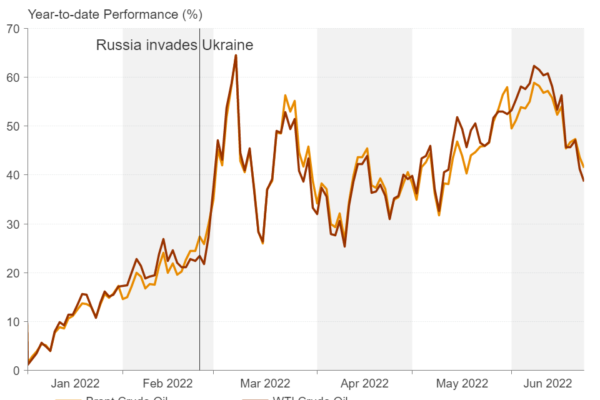

Oil’s Trendline Tango: Is This Just a Setback or a Major Shift in Outlook?

It’s Time to Talk Commodities A Year of Surprises It’s been a stellar year for commodities as geopolitical turmoil and the pandemic have sparked a global supply crunch in industrial, energy, and agricultural sectors. Who would have thought that a year filled with so much chaos and uncertainty would end up benefitting the commodities market?…

KPMG Sounds the Alarm: UK Faces Significant Risk of Recession with Downside Threats

UK Economy at Risk of “Mild Recession”: A Closer Look at the KPMG Report UK Times citing KPMG’s UK Economic Outlook report: The UK economy is at significant risk of entering a “mild recession” next year. The report cites soaring inflation rates, stagnant wage growth, and ongoing uncertainty surrounding Brexit as key factors contributing to…

Unleashing the Power of Elliott Wave Analysis: A Quirky Take on EUR/USD’s Future – June 27th, 2022

EURUSD Elliott Wave Analysis Is Germany’s Energy Shortage A Threat to Bulls? Last week, the EURUSD climbed by about 60 pips, showing some bullish momentum. However, with Germany facing the possibility of an energy shortage-induced recession, many are questioning whether the bulls stand a chance in the current market conditions. The Elliott Wave Principle’s Perspective…