Unpacking the Dollar’s Rise: A Reflection on Risk Aversion and Quiet Trading

Description:

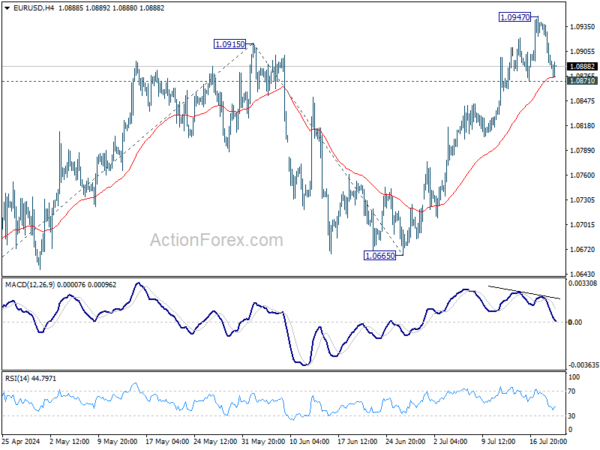

Risk aversion continues to support Dollar in relatively quiet trading today. Both Sterling and Canadian Dollar weakened mildly after worse-than-expected retail sales data. Euro shrugged off dovish comments from some ECB officials. Meanwhile, Yen softened slightly following lower-than-expected CPI core reading. However, overall movements in the currency markets remain limited as traders hold their bets.

Blog Post:

As we witness the Dollar’s rise in the currency markets, it is crucial to reflect on the underlying factors that are driving this trend. Risk aversion seems to be playing a significant role in supporting the Dollar amidst relatively quiet trading conditions. The recent weakening of both the Sterling and the Canadian Dollar following disappointing retail sales data highlights the impact of economic indicators on currency movements.

Despite dovish comments from some ECB officials, the Euro has managed to remain resilient, showcasing its strength against external pressures. On the other hand, the Yen has softened slightly in response to lower-than-expected CPI core readings, indicating a nuanced interplay between economic data and currency valuation.

However, what stands out in the current market environment is the overall limited movements as traders adopt a cautious approach and hold their bets. This cautious sentiment reflects the uncertainty and unpredictability that continue to shape the global economy, leading investors to prioritize risk aversion strategies.

How It Will Affect Me:

The Dollar’s rise driven by risk aversion and quiet trading may impact me directly if I have investments tied to the currency market. It could lead to fluctuations in the value of my assets and influence my financial decision-making process. Staying informed about the underlying factors driving these market trends is essential for managing potential risks and maximizing opportunities.

How It Will Affect the World:

The Dollar’s gains on risk aversion amid quiet trading have broader implications for the global economy. It reflects the cautious outlook of traders and investors, signaling a preference for safe-haven assets like the Dollar during times of uncertainty. This trend could impact international trade, financial markets, and economic policies, shaping the interconnected nature of the world economy.

Conclusion:

In conclusion, unpacking the Dollar’s rise in the context of risk aversion and quiet trading provides valuable insights into the dynamics of the currency markets. Understanding these underlying factors and their implications is essential for navigating the complexities of the financial landscape and making informed decisions in an ever-changing global economy.