Tech Stocks Take a Hit: A Heartfelt Analysis of the NASDAQ Rotation

Fundamental Overview

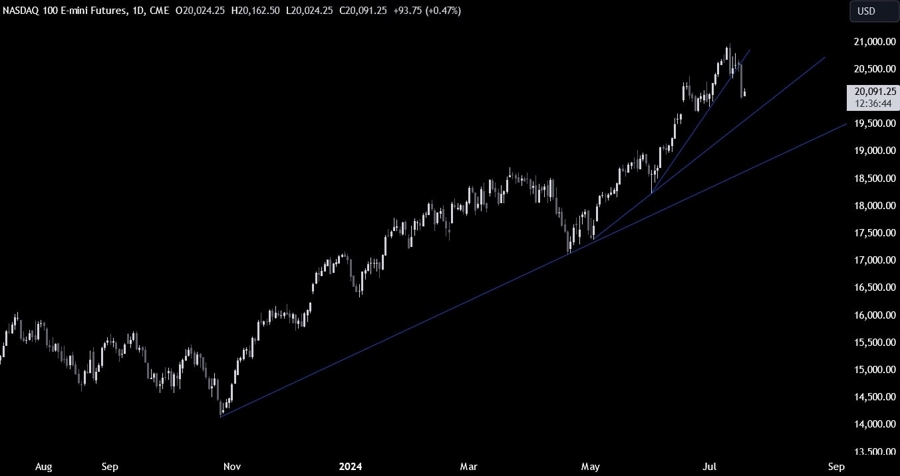

The Nasdaq posted its biggest daily decline since December 2022 yesterday as the rotation out of big tech stocks into more rate sensitive names continues. We can clearly see this internal market dynamic unfolding as the Russell 2000 and the Dow keep on gaining.

In the big picture, the fundamentals did not change, on the contrary the soft-landing narrative strengthened as we continue to see inflation falling while the economy continues to grow. This week, we got more positive data on jobs and manufacturing, which adds to the argument that the economic recovery remains on track.

How This Will Affect Me

As an individual investor with a portfolio heavily weighted in tech stocks, this rotation out of tech and into other sectors could mean a temporary drop in the value of my investments. It may be a good time to reassess my portfolio and consider diversifying into other industries that are currently performing well.

How This Will Affect the World

The rotation out of tech stocks and into more rate sensitive names could have a ripple effect on the global economy. Tech companies have been driving growth and innovation in recent years, so a decline in their stock prices could potentially slow down technological advancements and disrupt the overall market stability.

Conclusion

While the recent decline in tech stocks may be disheartening for investors, it is important to remember that market fluctuations are a natural part of the investing process. By staying informed and adaptable, investors can navigate these changes and potentially find new opportunities for growth in different sectors.