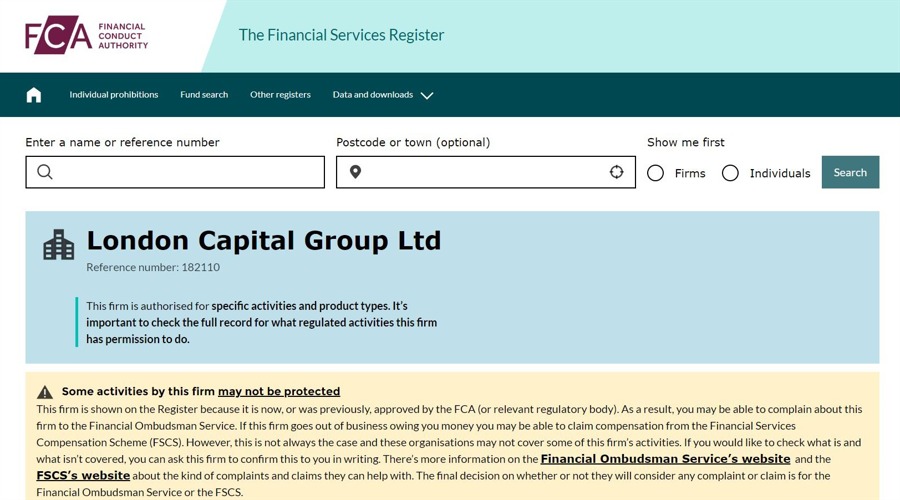

The UK’s Financial Conduct Authority Lifts Restrictions on London Capital Group Ltd

No Restrictions on LCG UK

The UK’s Financial Conduct Authority (FCA) has lifted all restrictions on the licence of London Capital Group Ltd (LCG), a retail forex and contracts for differences (CFDs) broker owned by the now-bankrupt FlowBank. The restrictions were imposed on 13 June following FlowBank’s bankruptcy.

LCG’s UK entity operates as an introducing broker for IG Group, which was once its direct competitor. The FCA’s previous actions against LCG included restrictions on onboarding new clients and managing client accounts to ensure the safety of investors in the wake of FlowBank’s collapse.

Impact on Individuals

For individual investors in the UK, the lifting of restrictions on LCG means greater access to trading opportunities in the forex and CFD markets. With the company now able to onboard new clients and manage accounts without limitations, investors can benefit from LCG’s services and potentially grow their portfolios.

Impact on the World

On a broader scale, the FCA’s decision to lift restrictions on LCG could signal a positive outlook for the financial services industry in the UK. By allowing LCG to resume its operations without constraints, the regulatory authority is demonstrating confidence in the company’s ability to uphold regulatory standards and protect the interests of investors.

Conclusion

In conclusion, the lifting of restrictions on London Capital Group Ltd by the UK’s Financial Conduct Authority is a significant development for both individual investors and the financial services industry as a whole. With LCG now able to operate freely, investors can explore new trading opportunities while regulatory confidence in the company is reaffirmed.