New Zealand CPI Data Analysis

Overview

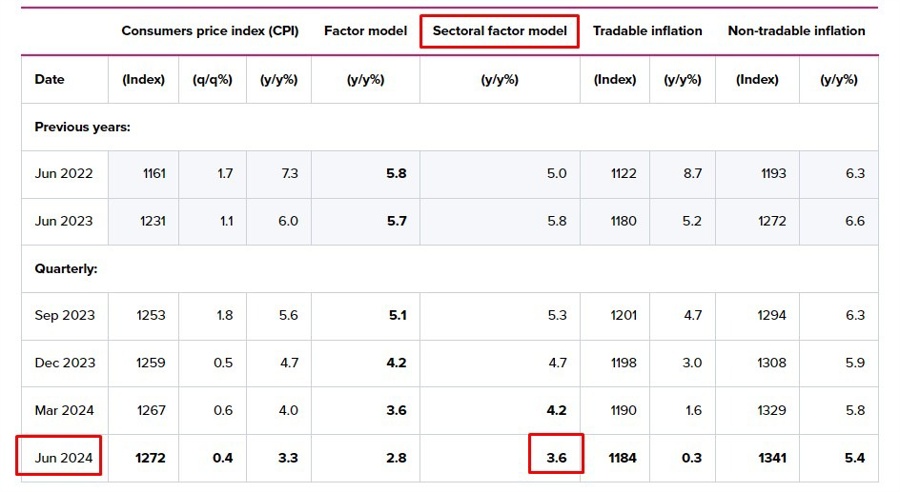

Earlier today, the official CPI data from New Zealand was released for Q2. The data showed a 0.4% increase quarter-on-quarter, slightly below the expected 0.5%, and a 3.3% increase year-on-year, just under the expected 3.4%. This has led ANZ to forecast a potential interest rate cut by the Reserve Bank of New Zealand in November, moving up their previous forecast from February 2025.

RBNZ Analysis

The Reserve Bank of New Zealand highlighted a clear disparity between tradable and non-tradable inflation in their recent report. The final four columns of the data further illustrate this divide.

The bank also introduced their sectoral factor model to analyze the inflation trends. This model estimates…

Impact on Individuals

For individuals in New Zealand, a potential interest rate cut could mean lower borrowing costs, making it more affordable to take out loans for mortgages, car loans, or other financing needs. However, it could also lead to lower returns on savings and investments.

Global Impact

The Reserve Bank of New Zealand’s decision to potentially cut interest rates could have ripple effects on the global economy. It may impact currency exchange rates, trade flows, and investor sentiment, influencing financial markets worldwide.

Conclusion

The New Zealand CPI data and the potential RBNZ interest rate cut signal shifting economic conditions in the country. It will be important to monitor how these developments unfold and adapt financial strategies accordingly.