Cyprus Reigns, Germany Gains in Cross-Border Investment Firms Landscape

New Report Highlights European Investment Trends

A new report from the European Securities and Markets Authority (ESMA) has unveiled a complex picture of cross-border investment services in the EU, with Cyprus emerging as the primary hub for firms while Germany claims the lion’s share of retail clients.

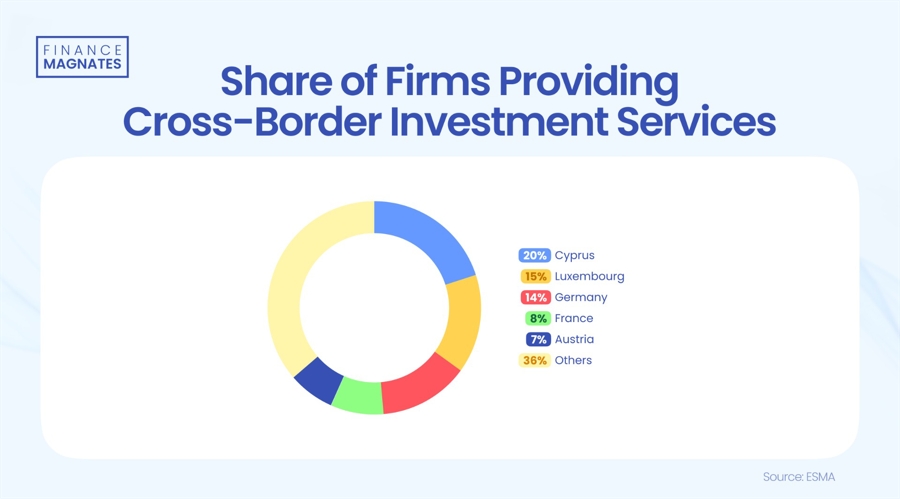

The annual analysis, which examined data from 386 firms across 30 EU and EEA jurisdictions, found that Cyprus is home to 20% of all firms providing cross-border investment services. This highlights the country’s growing reputation as a key player in the European investment landscape.

On the other hand, Germany has solidified its position as the top destination for retail clients, with a significant portion of investors choosing German firms to handle their cross-border investments. This trend reflects the country’s strong economy and stable financial sector.

The report also revealed a growing trend of firms expanding their operations across multiple EU and EEA jurisdictions, indicating a push towards greater international cooperation and integration within the European investment industry.

Overall, the findings of the report paint a dynamic and evolving picture of the cross-border investment landscape in Europe, with Cyprus and Germany emerging as key players in this complex ecosystem.

How Will This Affect Me?

As an individual investor, the dominance of Cyprus and Germany in the cross-border investment landscape may have implications for the services and options available to you. It’s important to stay informed about these trends and consider how they may impact your investment decisions.

How Will This Affect the World?

The growing influence of Cyprus and Germany in the European investment industry could have broader implications for the global economy. As these countries attract more firms and investors, they may play a larger role in shaping international financial markets and regulations.

Conclusion

The report from ESMA offers valuable insights into the evolving landscape of cross-border investment services in Europe. With Cyprus reigning as a key hub for firms and Germany gaining traction with retail clients, it’s clear that the industry is undergoing significant changes. As these trends continue to unfold, it’s essential for investors and policymakers to adapt to the shifting dynamics of the European investment market.