USD/CHF and EUR/GBP Analysis

USD/CHF

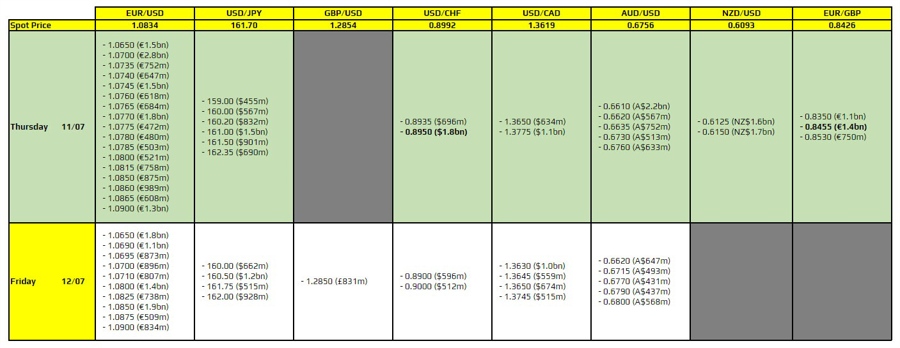

0.8950 Level

On the day, the 0.8950 level in the USD/CHF pair doesn’t hold any significant technical importance, but it could face downside pressure as it aligns with the weekly pivot. The more intriguing aspect is the price ceiling at around 0.9000. This level is closely hugging both the 200-hour and 100-day moving averages, indicating potential resistance for price action.

EUR/GBP

0.8455 Level

Another level to watch out for is at 0.8455 in the EUR/GBP pair. This level could potentially act as a key support or resistance point, influencing price movement in the pair.

Overall, keeping an eye on these key levels and understanding their significance in the technical analysis of these currency pairs can help traders make more informed decisions in the forex market.

How Will This Affect Me?

As a trader in the forex market, being aware of these key levels in the USD/CHF and EUR/GBP pairs can help you make better trading decisions. Understanding the technical analysis behind these levels can provide valuable insights into potential price movements and levels of support and resistance.

How Will This Affect the World?

The movements in currency pairs like USD/CHF and EUR/GBP can have wider implications for the global economy. Shifts in exchange rates between major currencies can impact international trade, investment, and overall economic stability. Monitoring these key levels and understanding their significance can provide valuable insights into broader market trends.

Conclusion

Keeping a close watch on key levels in currency pairs like USD/CHF and EUR/GBP is essential for traders looking to navigate the forex market effectively. By understanding the technical analysis behind these levels, traders can make more informed decisions and stay ahead of market trends. Additionally, the movements in these currency pairs can have ripple effects on the global economy, making it crucial for market participants to stay informed and adapt to changing market conditions.