The Impact of EUR/USD Break above 1.0800

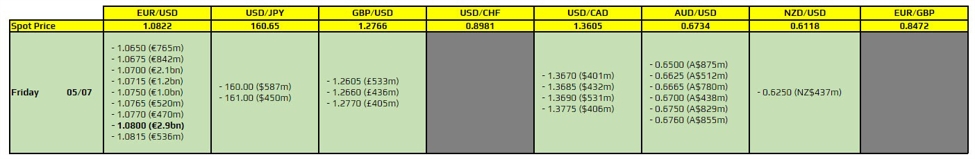

There is just one to take note of, as highlighted in bold. That being for EUR/USD and a rather large one at that at the 1.0800 mark. However, the US holiday yesterday and dollar sluggishness on the week has seen price action move beyond the range of what I would’ve expected to be the upper bound for the pair this week. EUR/USD is instead now looking for more of a bullish turnaround above 1.0800 on a break above its 100 and 200-day moving averages as well. That said, the expiries could still lock p…

How will this affect me?

As an individual, the break above 1.0800 in the EUR/USD pair could have several implications for you depending on your financial situation. If you are a forex trader, this could present an opportunity for potential profits if you are able to capitalize on the bullish momentum in the pair. On the other hand, if you have investments or savings tied to the value of the US dollar, this shift could impact the value of your assets.

How will this affect the world?

The break above 1.0800 in the EUR/USD pair could have broader implications for the global economy. A strengthening Euro against the US dollar could impact international trade, making European goods more expensive for American consumers and potentially affecting export levels. Additionally, this shift in the forex market could influence central bank policies and global market sentiment, leading to ripple effects across various industries.

Conclusion

In conclusion, the break above 1.0800 in the EUR/USD pair marks a significant development in the forex market with potential implications for both individuals and the global economy. It is important to stay informed and monitor the situation closely to assess any potential risks or opportunities that may arise as a result of this shift in market dynamics.