EUR/USD and USD/CHF Options Expiries to Impact Price Action

EUR/USD Rangebound Movement Expected

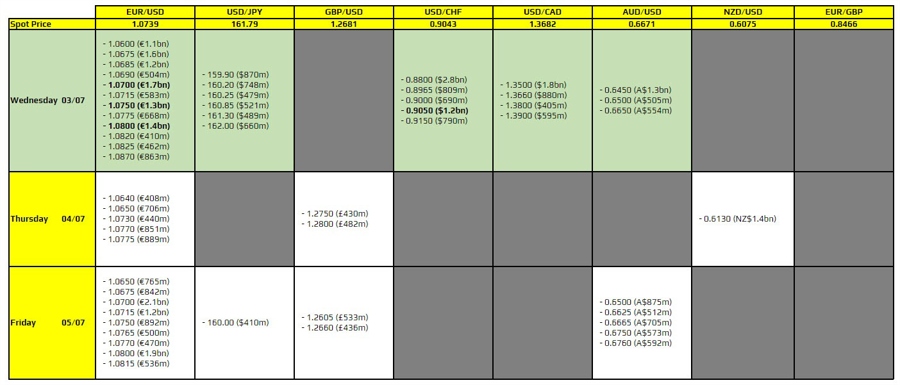

There are a couple of key options expiries to take note of on the day, as highlighted in bold. The first ones are for EUR/USD and they are layered between 1.0700 through to 1.0800, with another large one sandwiching that at 1.0750. As such, price action is likely to keep more muted once again with more of the same expiries seen on Friday. That will see the pair hold more rangebound before we get to the US jobs report at least. That especially with tomorrow being a US holiday.

USD/CHF Option Expiry at 0.9

Besides that, there is one major options expiry for USD/CHF at 0.9. This level is expected to act as a strong magnet for price action, potentially causing the pair to consolidate around this key level. Traders should keep a close eye on how price reacts to this expiry as it could dictate short-term directional bias for the currency pair.

How Options Expiries Affect Traders

Options expiries can have a significant impact on price action in the forex market. Traders often use these expiries to gauge potential levels of support or resistance and adjust their trading strategies accordingly. The clustering of options expiries around certain levels can create a magnetic effect on price action, leading to increased volatility or rangebound movement.

How Options Expiries Affect the Global Forex Market

Options expiries not only impact individual currency pairs but can also have broader implications for the global forex market. Large expiries at key levels can influence market sentiment and lead to shifts in investor behavior. Traders around the world pay close attention to these expiries as they can provide valuable insights into market dynamics and potential trading opportunities.

Conclusion

Options expiries play a crucial role in shaping price action in the forex market. Traders should closely monitor these expiries, especially when clustered around key levels, as they can provide valuable insights into potential market movements. By understanding the impact of options expiries, traders can make more informed trading decisions and capitalize on emerging opportunities in the market.