It’s a subdued data agenda ahead for today

Japan weekly flows and Australian May trade data is about it

Speaking of Japan

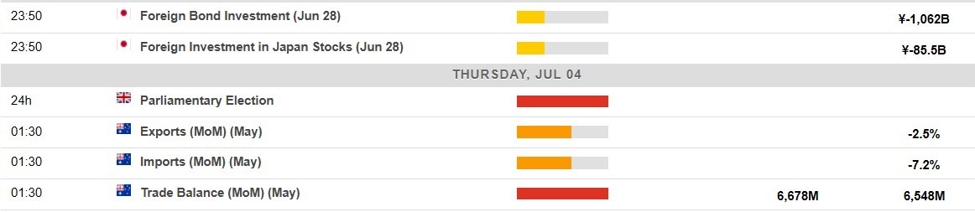

Trading of US Treasuries (physical) will be closed for the 04 July 2024 US holiday. The UK election voting kicks off in a few hours time. This snapshot from the ForexLive economic data calendar, access it here. The times in the left-most column are GMT.

The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the c…

Today seems to be a slow day in terms of economic data releases, with Japan and Australia taking center stage. The lack of major data points may lead to lower volatility in the markets as traders await more impactful news. However, this doesn’t mean that there won’t be any opportunities for those looking to make trades.

Japan’s weekly flows and Australian May trade data can still provide valuable insights into the health of their respective economies. It’s always important to stay informed about the latest data releases, as they can have a significant impact on market sentiment and direction.

Meanwhile, US Treasuries trading will be closed for the 04 July 2024 US holiday, which could lead to reduced liquidity in the market. Traders should be cautious and mindful of potential price gaps or increased volatility during this time.

On the political front, the UK election voting is set to kick off soon, adding another layer of uncertainty to the markets. Investors may be keeping a close eye on the developments to gauge the potential impact on the economy and financial markets.

How this will impact me

As an individual investor, today’s subdued data agenda may result in lower trading opportunities or market volatility. It’s important to stay patient and wait for clearer signals before making any significant trading decisions. Keeping an eye on the latest news and developments can help you navigate the markets more effectively.

How this will impact the world

While today’s economic calendar may seem quiet, the outcomes of Japan’s weekly flows and Australian May trade data can still have reverberations on the global economy. Any unexpected results or trends could influence market sentiment and investor confidence worldwide. Additionally, political events like the UK election voting can introduce new uncertainties that may impact international markets and trade relations.

Conclusion

Despite a subdued data agenda for today, there are still potential opportunities and risks that traders and investors should be mindful of. Staying informed and keeping a close watch on market developments is crucial in navigating the current economic landscape. While the focus may be on Japan and Australia, global events like the US holiday and UK election voting can also shape market dynamics. It’s always important to stay vigilant and adaptable in the ever-changing world of finance.