What Aussie CPI Data Means for May

Implications for Consumers

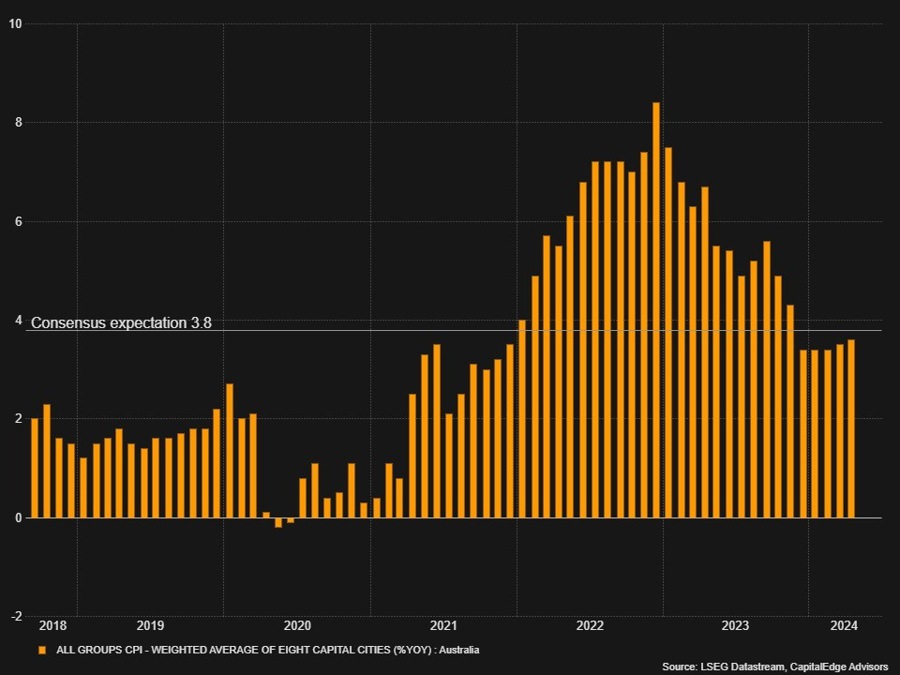

The Australian Consumer Price Index (CPI) data for May is set to be released at 02:30 BST, and the results could have significant implications for consumers. Some analysts are predicting that the monthly measure of headline inflation will remain flat due to seasonal discounts on holiday expenses and clothing, as well as a decrease in retail gasoline prices. However, the yearly measure is expected to increase to 3.8%, the highest level since November 2023.

With the Reserve Bank of Australia (RBA) choosing to hold interest rates steady at their recent meeting, consumers may not see an immediate impact on borrowing costs. However, a higher inflation rate could lead to increased prices on goods and services, putting pressure on household budgets.

Global Effects

The Australian CPI data could also have implications beyond its borders. A rise in inflation could potentially signal a strengthening economy, which may have a positive impact on global markets. Conversely, if inflation continues to climb, it could lead to concerns about overheating and prompt central banks in other countries to reconsider their own monetary policies.

Conclusion

As the Aussie CPI data for May is released, consumers and investors alike will be watching closely to see how inflation trends are evolving. Whether the results show a modest increase or a more significant jump, the data will provide valuable insight into the state of the Australian economy and its potential impact on the global market.

How this will affect me:

As an individual consumer, a higher inflation rate could mean increased prices for goods and services, putting pressure on your personal finances. If borrowing costs do eventually rise as a result, it may become more expensive to take out loans or mortgages.

How this will affect the world:

On a global scale, the Australian CPI data could impact international markets, signaling the health of the Australian economy and potentially influencing the decisions of central banks in other countries. A rise in inflation could lead to concerns about inflationary pressures spreading to other parts of the world, prompting policymakers to take action to mitigate risk.