Today’s Top Events in the Forex Market

Description:

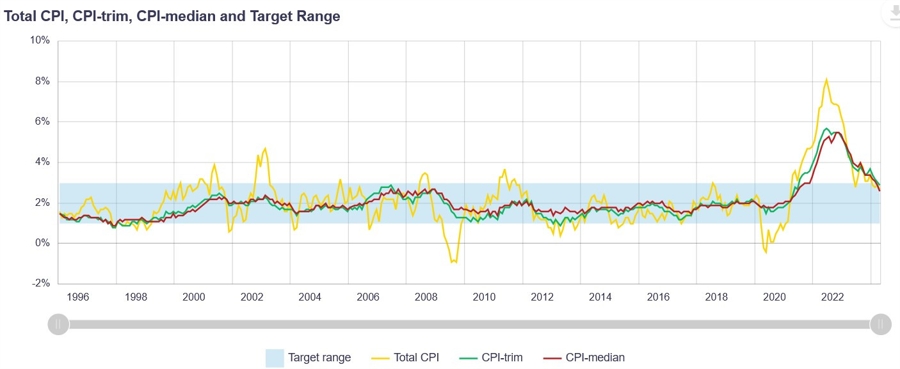

Today there’s no notable event in the European session and all the action will take place in the American session as we get to see the Canadian CPI data and the US Consumer Confidence report. 12:30 GMT/08:30 ET – Canada May CPI The Canadian CPI Y/Y is expected at 2.6% vs. 2.7% prior, while the M/M measure is seen at 0.3% vs. 0.5% prior. The Trimmed Mean CPI Y/Y is expected at 2.8% vs. 2.9% prior, while the Median CPI Y/Y is seen at 2.6% vs. 2.6% prior. The last report showed the underlying inflation pressures remain…

Effects on Me:

As a forex trader, today’s events in the forex market could have a significant impact on my trading decisions. The release of the Canadian CPI data and US Consumer Confidence report will likely lead to increased volatility in the market, presenting both opportunities and risks for traders like myself. It is important for me to stay informed and closely monitor these events in order to make informed trading decisions and maximize potential profits.

Effects on the World:

The outcome of today’s events in the forex market could have broader implications for the global economy. A higher than expected Canadian CPI could signal rising inflationary pressures in the country, potentially leading to changes in monetary policy. Similarly, the US Consumer Confidence report could provide valuable insights into the health of the US economy and consumer sentiment, which can impact global financial markets and investor confidence.

Conclusion:

In conclusion, today’s top events in the forex market have the potential to significantly impact both individual traders and the global economy. It is crucial for traders to stay informed and adapt their trading strategies accordingly in response to the outcomes of the Canadian CPI data and US Consumer Confidence report. By closely monitoring these events, traders can position themselves to capitalize on market opportunities and navigate potential risks effectively.