Heading into the Trump/Biden debate this week

Goldman’s Expectations for a Republican Victory

USD: Upside bias under a Republican victory

This week, all eyes are on the upcoming debate between President Donald Trump and former Vice President Joe Biden. As anticipation grows, Goldman Sachs has released a note outlining their expectations for a Republican victory and its potential effects on the economy.

One key point highlighted in Goldman’s note is the potential impact on the US dollar. Under a Republican victory, there is an upside bias for the USD. This is due to the proposed tariff policies by Trump, which could lead to a strengthening of the dollar.

Tariff Policies and Market Expectations

Trump has proposed various tariff policies, including a 10% across-the-board tariff on imports and a 60% tariff on imports from China. These policies are expected to reduce import volumes and increase demand for domestic goods, ultimately benefiting the US dollar.

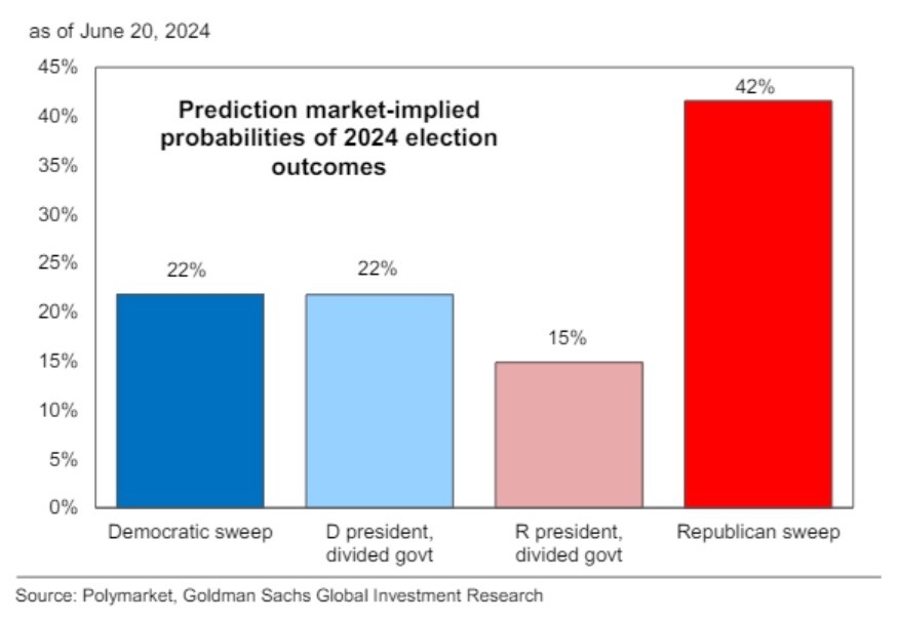

Market expectations are also in focus, with prediction markets suggesting…

How this will affect me

As a consumer, a Republican victory could potentially lead to higher prices on imported goods due to the proposed tariff policies. This could impact my spending habits and overall cost of living.

How this will affect the world

On a global scale, a Republican victory and the implementation of tariff policies could create trade tensions and disrupt international markets. This could have ripple effects on economies around the world and lead to increased volatility in the global economy.

Conclusion

Heading into the Trump/Biden debate this week, Goldman’s expectations for a Republican victory have shed light on the potential impact on the economy. With a focus on tariff policies and market expectations, the outcome of the election could have far-reaching consequences for both individuals and nations worldwide.