The Disconnect Between Soft Data and Hard Data

What happened with the US Flash PMI print?

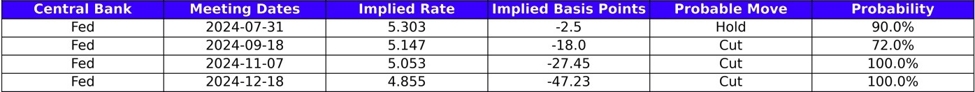

Despite a solid US Flash PMI print on Friday, money market bets for the Fed wasn’t much changed. Expectations into the data was for around 47 basis points of easing by year-end, and expectations stayed very close to that despite the beat.

The Disconnect

It’s important to keep in mind that there has been a disconnect between soft data (surveys like the PMIs) and the hard data for a while now, and the hard data continues to show moderating growth and inflation. So, it’s arguably not too surprising to see markets…

As we look at the data and the trends, it’s clear that there is a gap between what surveys are showing and what the actual economic indicators reflect. This discrepancy can lead to uncertainty in the markets and may impact investor sentiment moving forward.

In the short term, this disconnect may cause some confusion and volatility in the markets as investors try to make sense of the mixed signals. However, in the long term, it’s important to focus on the underlying economic fundamentals and trends to get a clearer picture of where the economy is heading.

How will this affect me?

The disconnect between soft data and hard data can have a direct impact on individual investors. It may lead to increased uncertainty in the markets and could affect investment decisions. It’s important for individual investors to stay informed and keep a close eye on the underlying economic fundamentals to make informed decisions.

How will this affect the world?

The disconnect between soft data and hard data in the US can have ripple effects across the global economy. As one of the largest economies in the world, any uncertainty or volatility in the US economy can impact global markets and investor sentiment. It’s important for countries and investors around the world to monitor the situation closely and be prepared for any potential impacts on their own economies.

Conclusion

In conclusion, the disconnect between soft data and hard data in the US economy is a trend that has been observed for some time now. While it may cause short-term confusion and volatility in the markets, it’s important to focus on the underlying economic fundamentals to get a clearer picture of where the economy is heading. Individual investors and countries around the world should monitor the situation closely and be prepared for any potential impacts on their own economies.