Feeling the Market Rollercoaster: A Week in Forex Trading

Overview

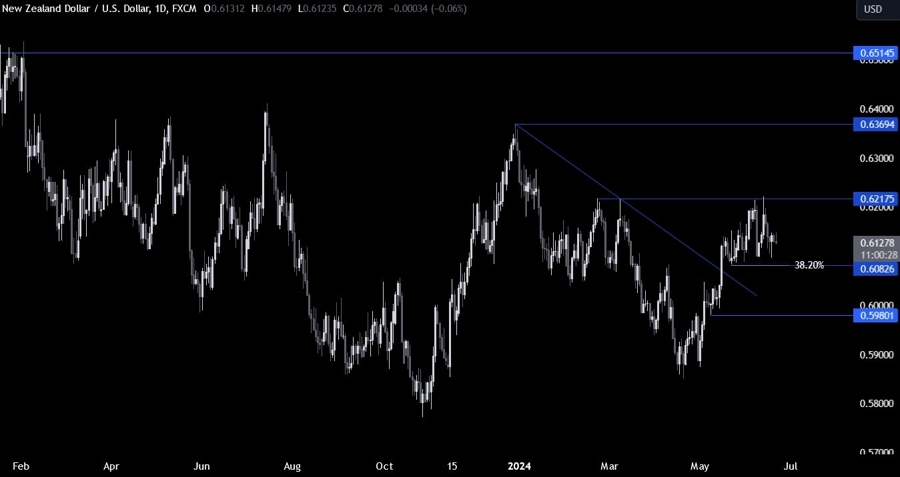

The USD has been generally weaker this week after the strength seen last week due to some risk-off sentiment. In fact, it looks like it’s just sentiment that’s been driving the market recently as fundamentally the soft US inflation figures just consolidated the market’s expectation of two cuts for this year despite a bit more hawkish than expected FOMC decision. The NZD, on the other hand, got pressured mainly because of the risk-off sentiment and the US Dollar strength.

Market Analysis

This week’s forex market has been a wild ride, with the USD weakening due to the prevailing risk-off sentiment and soft US inflation figures. The market has priced in expectations of two rate cuts this year, despite a slightly more hawkish than expected FOMC decision. On the flip side, the NZD has faced pressure from the same risk-off sentiment and the strength of the US Dollar, creating a challenging environment for traders.

Personal Impact

As an individual forex trader, these fluctuations in the market can have a direct impact on your trading strategy and potential profits. It’s important to stay informed and adapt quickly to changes in market sentiment and economic data to make well-informed trading decisions.

Global Impact

On a larger scale, the movements in the USD and NZD can have ripple effects across global markets and economies. Changes in the value of these currencies can impact international trade, investment flows, and economic stability in various countries around the world.

Conclusion

As we navigate through the ups and downs of the forex market, it’s crucial to stay vigilant and adaptable in order to make the most of trading opportunities. By understanding the underlying factors driving market movements and staying informed about global economic developments, traders can better position themselves for success in this dynamic and ever-changing market.