RBA Policy Meeting May Be Muted; Aussie Holds in Downward Channel

RBA interest rate expected to remain unchanged

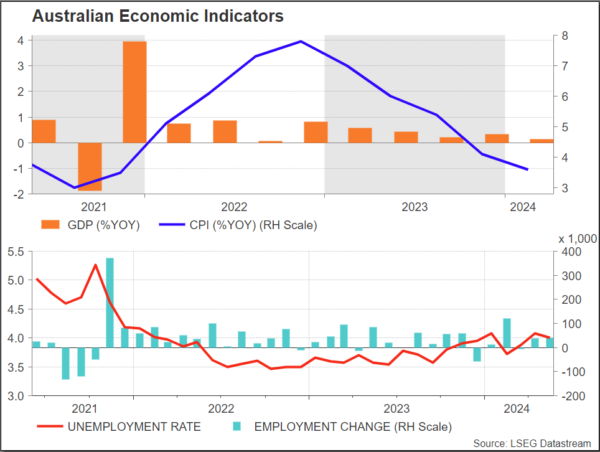

Sticky inflation and the economy’s uncertainty are still a concern as the Reserve Bank of Australia (RBA) gears up to announce its June policy decision early on Tuesday at 04:30 GMT. It is widely anticipated that the RBA will keep interest rates steady, in line with the central bank’s agenda.

Australia’s uncertain economy and sustained inflation

The RBA continues to grapple with an uncertain economic outlook for Australia, with inflation remaining stubbornly high. The central bank is likely to maintain its current stance in an effort to support the economy amidst ongoing challenges.

The Aussie dollar has been trading in a downward channel ahead of the RBA’s decision, reflecting market uncertainty and caution among investors. The currency’s performance will closely track the central bank’s stance on interest rates and economic conditions.

Overall, the RBA policy meeting is expected to be muted, with the central bank likely choosing to hold steady amid ongoing economic challenges. Investors will be watching closely for any signs of potential shifts in the RBA’s outlook and policy stance.

How will this affect me?

As a consumer or investor in Australia, the RBA’s decision to keep interest rates unchanged could have implications for mortgage rates, savings account yields, and overall economic stability. It is important to stay informed about the central bank’s actions and the broader economic landscape.

How will this affect the world?

The RBA’s policy stance can have ripple effects beyond Australia’s borders, impacting global trade and financial markets. Investors around the world will be monitoring the central bank’s decision for insights into the broader economic outlook and potential investment opportunities.

Conclusion

With the RBA expected to keep interest rates unchanged, the upcoming policy meeting may be relatively uneventful. However, the central bank’s decisions have far-reaching implications for Australia and the global economy, underscoring the importance of staying informed and monitoring developments closely.