Surprised by the USD’s lack of reaction to PPI and Initial claims data?

Me too.

We know PPI doesn’t usually see the same type of volatility as we would see with CPI data of course, but the numbers were punchy.

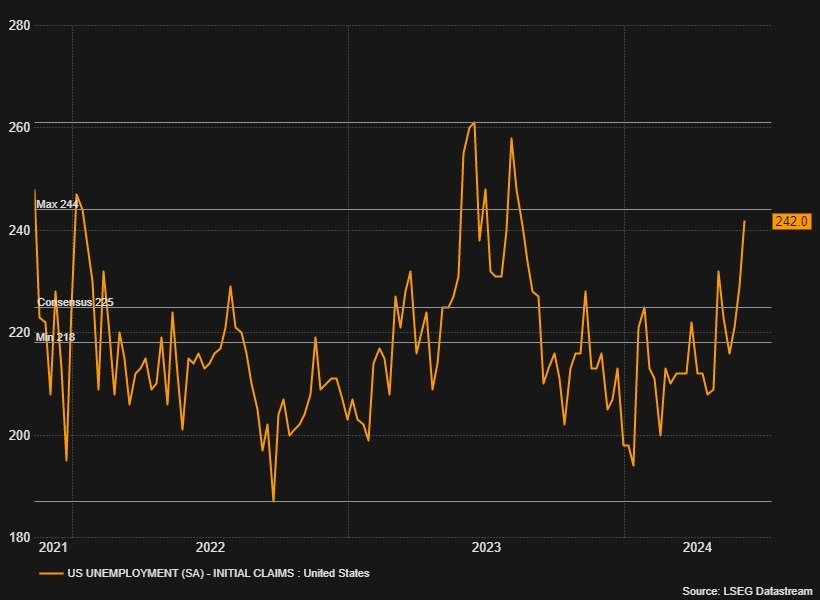

It wasn’t just the PPI numbers which were much softer than expected, but Initial Claims jolted higher as well, and is showing the first real signs of concerns going back to June 2023. So, what’s up with the USD pushing higher after data like this?

I think the USD got caught in the risk sentiment shift that has been happening in the market. Investors are likely interpreting the weaker PPI and higher Initial Claims as potential signs of economic slowdown, which could lead to the Federal Reserve delaying its tapering plans or even extending its easy monetary policy. This has led to some risk-off sentiment, causing the USD to strengthen as investors seek safe-haven assets.

Despite the lackluster reaction to the data, it’s important to remember that the forex market is influenced by a multitude of factors, not just economic indicators. Geopolitical events, market sentiment, and technical factors can all play a role in currency movements.

As an individual, the impact of the USD’s reaction to the PPI and Initial Claims data may not be immediately apparent. However, if you are involved in international trade or investments, a stronger USD could impact the cost of imported goods or the value of your investments in foreign currencies.

On a global scale, the USD’s reaction to economic data can have far-reaching consequences. A stronger USD can make US exports more expensive, potentially impacting trade balances and economic growth in other countries. It can also influence commodity prices, as many commodities are priced in USD. Central banks around the world closely monitor the USD’s movements as part of their monetary policy decisions.

In conclusion,

While the lack of reaction to the PPI and Initial Claims data may be surprising, it’s important to consider the broader market context and the multiple factors at play in the forex market. The USD’s strength or weakness can have implications for individuals and global economies alike, highlighting the interconnected nature of the financial markets.