Welcome back from the long weekend!

US dollar sellers spring into action

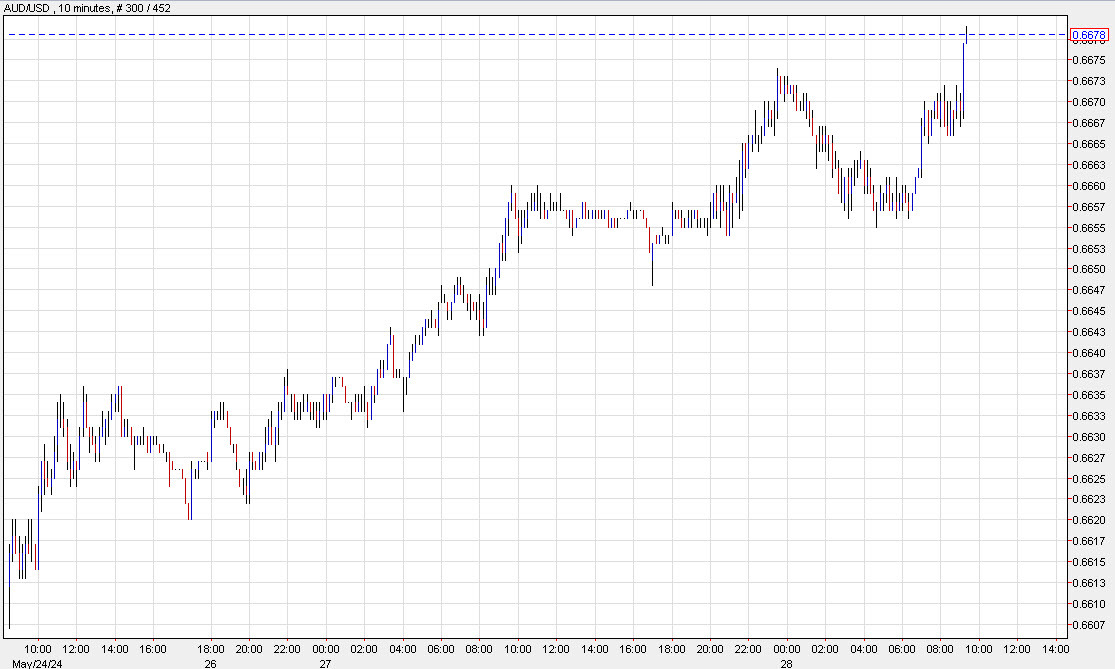

New York returns from a long weekend, and US dollar sellers have wasted no time in making their move. The dollar is hitting new lows, with GBP and AUD emerging as the big winners for the second consecutive day. Gold is also on the rise after a weak performance late last week.

As S&P 500 futures climb 8 points following a strong rally to close out last week, all eyes are on the market. Shares of Nvidia are up 3.3% to an impressive $1100 in the premarket, signaling good news for investors.

One of the major factors driving this positive trend is the bond market, as US 2-year yields are down 4.6 basis points to 4.91%. This shift indicates a sense of stability in the market, encouraging traders to act with confidence.

How will this affect me?

As a consumer or investor, this surge in the market could impact your purchasing power and investment decisions. With the US dollar weakening, it may be a good time to consider diversifying your portfolio or exploring international investment opportunities.

How will this affect the world?

The ripple effects of the US dollar’s decline can be felt globally. It could lead to fluctuations in currency exchange rates, export-import dynamics, and international trade agreements. Countries heavily reliant on US dollar reserves may need to reassess their economic strategies in light of these developments.

Conclusion

In conclusion, the return of New York from the long weekend has brought about interesting shifts in the market. With the US dollar on the decline and various assets on the rise, it’s an exciting time for traders and investors alike. Keeping a close eye on market trends and being proactive in your decision-making will be key to navigating this dynamic landscape.