Deflating the Inflation Hype: A Closer Look at the CPI Report

Breaking Down the Numbers

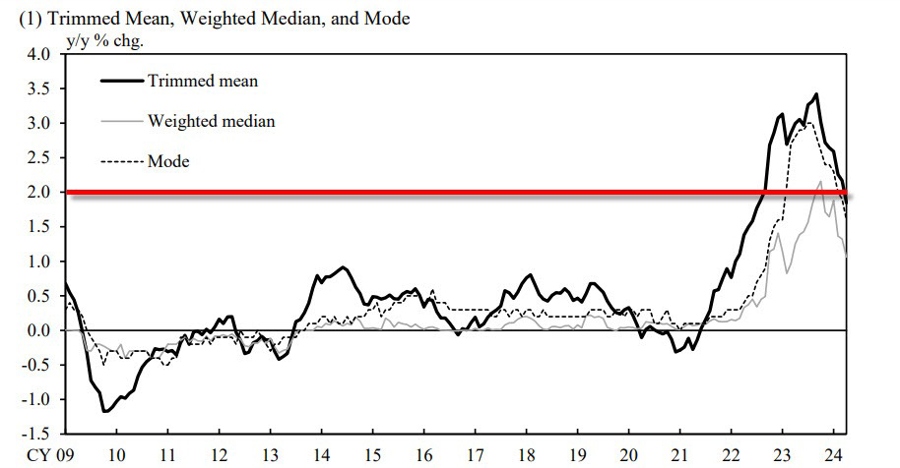

So, the latest CPI report is out, and it seems like everyone is abuzz about inflation numbers. Core prices have been holding steady above the 2% mark, which is definitely cause for concern. But hold onto your hat, folks, because when we take a closer look at our own measures of underlying inflation, the picture starts to look a little less dire.

The trimmed mean reading, in particular, has taken a nosedive, dropping to 1.8% in April from 2.2% in March. That’s a pretty significant drop, and it’s worth noting that the last time the trimmed mean reading dipped below 2% was way back in August 2022.

The BOJ’s Race Against the Clock

It was always going to be a tight race for the Bank of Japan to try and exit its ultra-easy monetary policy, and these latest inflation numbers are only adding fuel to the fire. With underlying inflation measures on the decline, the pressure is definitely on for the BOJ to make some tough decisions in the coming months.

Effects on Me

As a consumer, a drop in underlying inflation measures could actually be good news for me. It might mean that prices on everyday goods and services start to stabilize or even decrease, which would definitely be a welcome change in my budget.

Effects on the World

On a global scale, a decline in underlying inflation measures could have far-reaching effects. Central banks around the world may need to reevaluate their monetary policies, and investors could see some shifts in the markets as a result. It’s definitely something to keep an eye on in the coming months.

Conclusion

While the latest CPI report may have initially set off some alarms, a closer look at the underlying inflation measures reveals a more nuanced picture. With the trimmed mean reading dropping below 2% for the first time in nearly a year, the pressure is on for central banks to make some tough decisions. As consumers, we may start to see some relief in our budgets, while on a global scale, the effects of declining inflation measures could be far-reaching. It’s definitely a situation worth keeping an eye on as we move forward.