Fundamental Overview

The USD and CAD in Focus

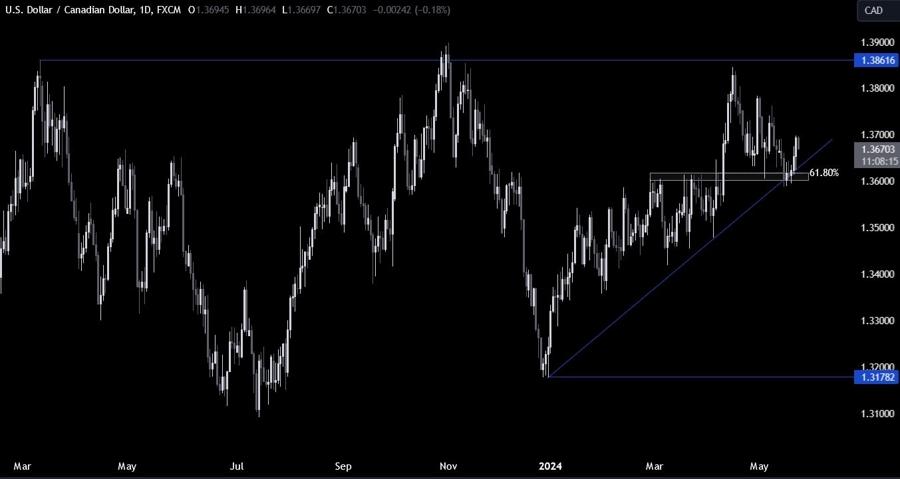

The USD has been generally under pressure since the benign US CPI report last week as the hawkish expectations subsided and the market switched its focus from inflation back to growth. This triggered a positive risk sentiment which is generally negative for the greenback.

The CAD, on the other hand, got pressured from the weaker than expected Canadian CPI figures which raised the chances of a rate cut in June (although it remains basically a coinflip). If the positive risk sentiment continues, it could further impact the CAD negatively.

How This Will Affect Me

If you are someone who deals with foreign exchange markets or trade internationally, the fluctuation in the USD and CAD can directly impact your financial transactions. It is important to stay updated on the latest news and trends to make informed decisions.

How This Will Affect the World

The movement of the USD and CAD can have ripple effects on the global economy, especially in terms of trade and investment. A weaker USD could potentially boost exports for the US, while a weaker CAD could make Canadian goods more attractive on the international market.

Conclusion

In conclusion, the recent developments in the USD and CAD are important factors to consider for traders and investors. Keeping an eye on the latest news and market trends will be crucial in navigating the volatile foreign exchange landscape.