Life as a Trader: Navigating the Current Market Landscape

What’s in Store for Today’s Trading?

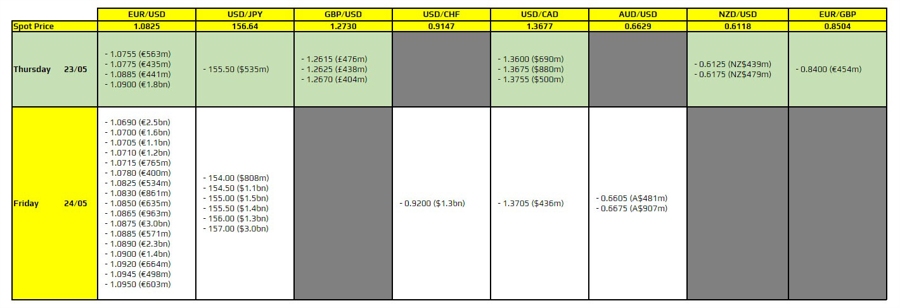

Well folks, it looks like we’re in for a bit of a mixed bag today in the world of trading. There aren’t any major expiries to take note of, so we’ll have to rely on other factors to guide us through the day ahead. On the agenda, we have PMI data and US weekly jobless claims to contend with. And let’s not forget about the tech sector, which is abuzz with excitement following Nvidia’s impressive earnings beat.

Trading Sentiment: A Rollercoaster Ride

With all these moving parts, it’s no wonder that trading sentiment is all over the place. On one hand, tech shares are soaring, but on the other, we have to consider the overall risk mood in the market. The dollar, meanwhile, is holding steady for the week. In particular, all eyes are on USD/JPY as it approaches a critical test of last week’s high of 156.78.

What Does This Mean for Me?

As a trader, today’s market conditions present both challenges and opportunities. The lack of major expiries means we’ll have to rely on other data points to inform our trading decisions. Keep a close eye on PMI data, jobless claims, and the tech sector for potential market-moving developments. And don’t forget to monitor USD/JPY for any potential breakout opportunities.

Global Implications: How Will the World Be Affected?

The current trading landscape isn’t just impacting individual traders—it has global ramifications as well. With tech shares surging and the dollar holding steady, markets around the world are feeling the effects of these developments. Keep an eye on how other major economies and currencies react to today’s market dynamics for insights into broader global trends.

In Conclusion: Navigating Uncertainty in Today’s Market

As we face a day of mixed trading sentiment and potential market-moving data releases, it’s important to stay nimble and adaptable in our trading strategies. By keeping a close watch on key indicators like PMI data, jobless claims, and tech sector performance, we can better position ourselves to capitalize on opportunities and navigate the uncertainties of the market with confidence.