USDCHF Moves Lower as USD Sells Off

Testing the 200 Hour Moving Average

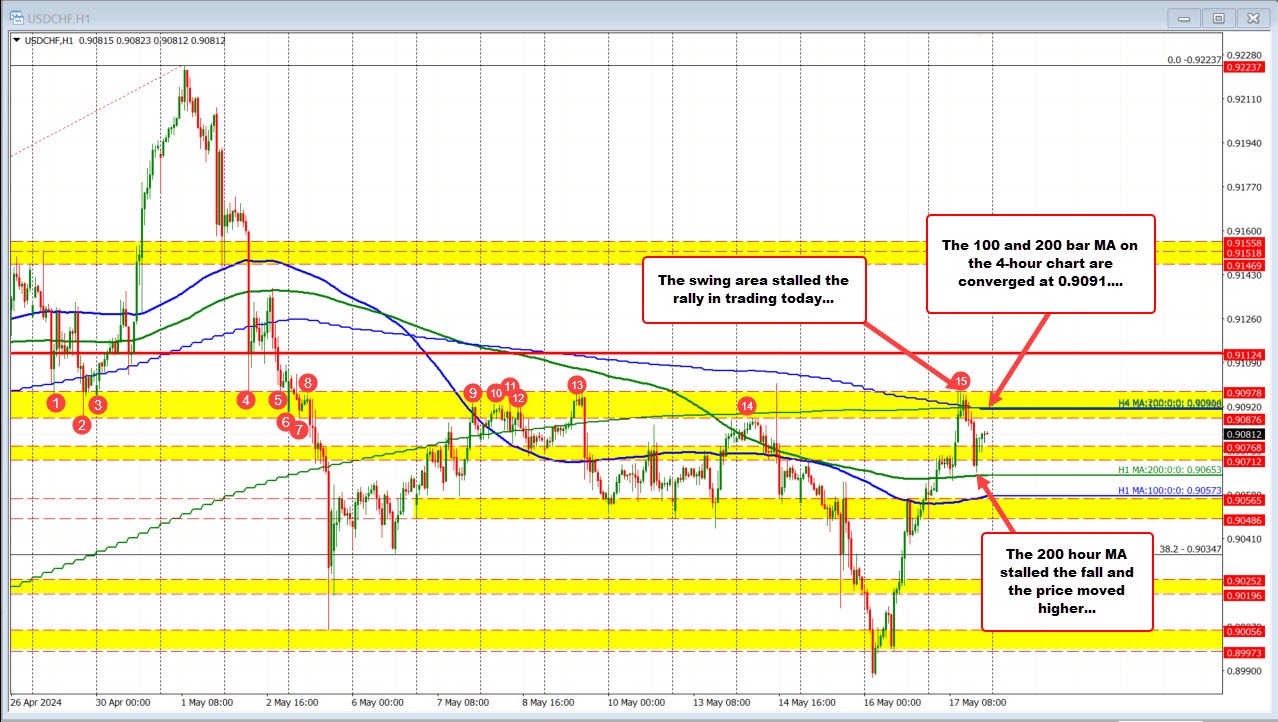

Today, the USDCHF saw a decrease in value as the USD sold off, causing the pair to move down and test the 200 hour moving average at 0.90653. However, support buyers stepped in at this level and managed to push the price back higher.

Trading Range and Moving Averages

Currently, the pair is trading between the 100/200 bar MAs on the topside at 0.9091 (with a swing area up to 0.90978), and the 200 hour MA below. As we approach the close of the week, it looks like the USDCHF will end in this range. Next week, these moving averages will likely act as support and resistance levels for the pair.

A break above or below these levels could indicate a shift in momentum and potentially lead to larger price movements.

Impact on Individuals

For individual traders and investors, the movement of the USDCHF can have a direct impact on their portfolios. Those holding positions in this currency pair may see gains or losses depending on how the market moves. It’s important to stay informed about these fluctuations and adjust your strategy accordingly.

Global Impact

On a larger scale, the movements of the USDCHF can also have an impact on the global economy. Changes in currency values can affect trade relations between countries, as well as the prices of imported and exported goods. This can in turn influence economic growth and stability worldwide.

Conclusion

Overall, the USDCHF’s recent movements reflect the ongoing volatility in the foreign exchange market. As traders and investors navigate these fluctuations, it’s important to stay alert and adapt to changing market conditions. Whether you’re an individual trader or a global economist, the USDCHF’s movements are worth keeping an eye on.