Another Decline in U.S. Leading Economic Indicators Signals Softer Conditions Ahead

Commentary on the U.S. LEI Report

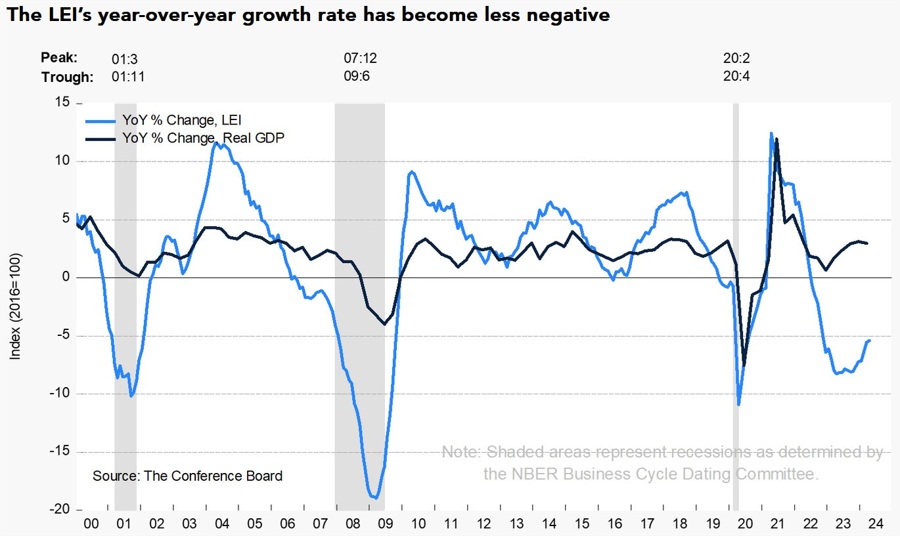

“Another decline in the U.S. LEI confirms that softer economic conditions lay ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Deterioration in consumers’ outlook on business conditions, weaker new orders, a negative yield spread, and a drop in new building permits fueled April’s decline. In addition, stock prices contributed negatively for the first time since October of last…

April’s U.S. Leading Economic Indicators (LEI) report revealed a decrease of 0.6%, falling short of the expected 0.3% decline and marking a downward trend from the previous month’s -0.3%. This data, compiled and released by The Conference Board, offers insights into the future direction of the U.S. economy by analyzing a composite of economic indicators.

Justyna Zabinska-La Monica, Senior Manager of Business Cycle Indicators at The Conference Board, emphasized the implications of this decline, pointing to several key contributing factors. A less optimistic consumer sentiment regarding business conditions, decreased new orders, a negative yield spread, and diminished new building permits were among the primary drivers of the April downturn in the U.S. LEI.

Additionally, stock prices played a role in the decrease, marking the first time they have negatively impacted the LEI since October of last year. This shift in the stock market’s influence on the leading indicators underscores the complex and interconnected nature of economic factors that contribute to the overall health of the economy.

Impact on Individuals

The decline in U.S. Leading Economic Indicators may have various implications for individuals. As the economy faces softer conditions ahead, consumers may experience reduced confidence in business conditions, potentially leading to changes in spending behavior and overall financial decision-making. Job seekers and those in the workforce could also face challenges as companies adjust to the evolving economic landscape.

Impact on the World

The ripple effects of the U.S. LEI decline extend beyond national borders, impacting the global economy at large. Weaker economic conditions in the United States can have widespread implications for international trade, investment, and economic growth. As the world’s largest economy faces challenges, other countries and regions may also feel the effects through interconnected financial markets and supply chains.

Conclusion

In conclusion, the recent decline in the U.S. Leading Economic Indicators serves as a warning sign of potential softening economic conditions ahead. By closely monitoring the evolving factors that contribute to these indicators, individuals, businesses, and policymakers can better prepare for the challenges and opportunities that lie ahead. As the global economy continues to navigate uncertainties, adaptation and strategic planning will be key in navigating the changing economic landscape.