The Intricacies of Currency Expiries and Moving Averages

What to Keep an Eye on Today

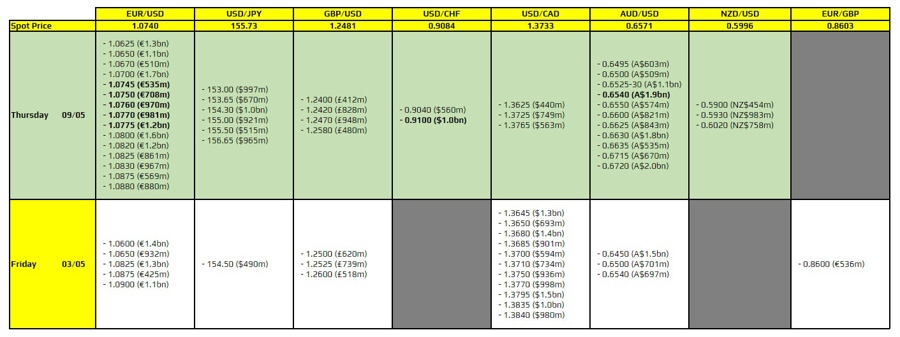

There are a couple of key points to take note of on the day, as highlighted in bold. The first is a range of expiries for EUR/USD from 1.0745 through to 1.0775. That is likely to help lock price action from running too far to the topside on the day. This, coupled with the presence of the 100-hour moving average at 1.0758, further reinforces the notion of a rangebound trading scenario. The pair is currently oscillating between the 100-hour moving average and its 200-hour moving average at 1.0730.

Another important point to consider is the expiry at the 0.9100 level for USD/CHF. This particular level could serve to keep price action more contained and prevent any wild swings in the market.

How This May Impact Individuals

For individual traders, being aware of these key expiries and moving averages can provide valuable insights into potential price movements. By understanding the significance of these levels, traders can make more informed decisions when entering or exiting positions.

How This May Impact the World

On a broader scale, the impact of these expiries and moving averages can influence the overall market sentiment and trading dynamics. As major currency pairs like EUR/USD and USD/CHF react to these key levels, it can have a ripple effect on global forex markets and potentially shape future trends in the currency market.

Conclusion

In conclusion, keeping a close eye on expiries and moving averages in the forex market can provide valuable insights for both individual traders and the broader market. By understanding the significance of these key levels, traders can navigate the market more effectively and potentially capitalize on profitable trading opportunities.