The Impact of US PMI Data on Fed Outlook

Soft US PMI Data Keeping Fed Outlook Interesting

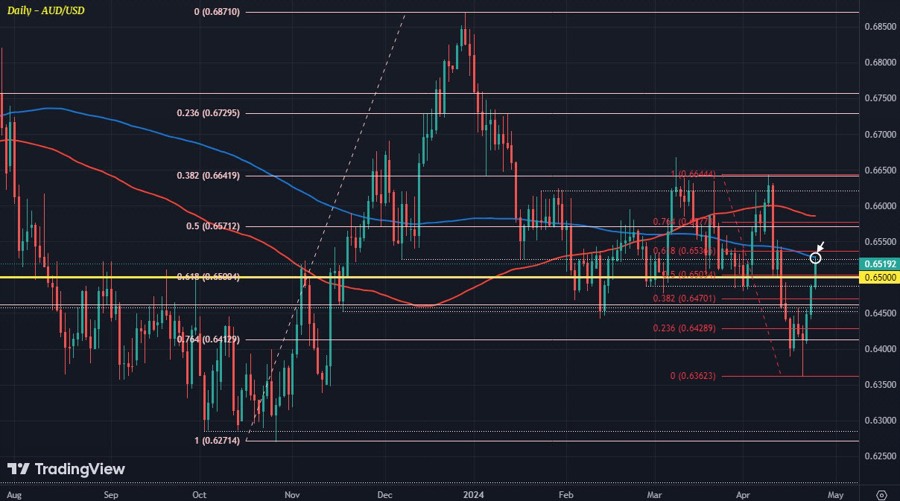

After the softer US PMI data yesterday, it is keeping the Fed outlook more interesting. The dollar fell as traders might have to consider at least one rate cut for the year. But in the case of the aussie, it doesn’t seem like rate cuts might be on the table for this year. That especially as inflation data remains rather sticky.

Trimmed Mean Reading at 4.0%

The trimmed mean reading is the most pivotal one and that is seen at 4.0%. Yes, it is down from 4.2% previously but still not enough to convince of a significant change in the economic outlook.

Overall, the latest US PMI data has added a layer of uncertainty to the Fed’s monetary policy decisions moving forward. Traders will be closely monitoring any further developments to gauge the potential impact on the markets.

How Will This Impact Me?

As an individual investor, the softer US PMI data may lead to increased market volatility and fluctuations in asset prices. It could also influence the Fed’s decision-making process, potentially affecting interest rates and overall economic conditions.

How Will This Impact the World?

The impact of the US PMI data on the Fed’s outlook can have global repercussions, as it may influence international trade, investment decisions, and market sentiment. Countries with close economic ties to the US will be particularly affected by any changes in US monetary policy.

Conclusion

In conclusion, the softer US PMI data has added a layer of uncertainty to the Fed’s outlook, prompting speculation about potential rate cuts in the future. It will be important to keep a close eye on further developments to assess the full impact on both individual investors and the global economy.