My Experience with the FOMC Blackout Policy

Feeling Silenced by the Fed

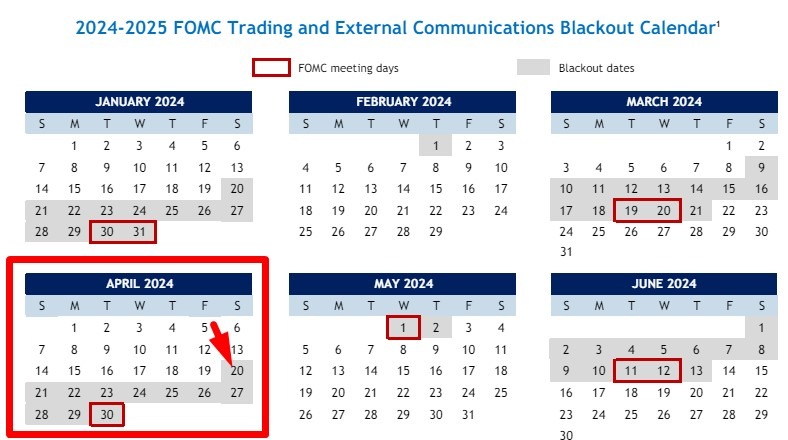

As a financial enthusiast, I eagerly await the Federal Open Market Committee (FOMC) statement, which is due on May 1. However, my excitement is often dampened by the ‘blackout’ policy from the Federal Reserve. This policy limits the extent to which Federal Open Market Committee participants and staff can speak publicly or grant interviews.

The blackout period begins the two Saturdays preceding a FOMC meeting and ends the Thursday following the decision, which is always on Wednesdays. During this time, Federal Reserve officials are not allowed to make any public statements or speeches that could potentially impact market expectations.

The Unintended Consequences

Oftentimes, Federal Reserve officials will schedule important speeches just before the blackout period begins or right after it ends in order to communicate their views to the public without violating the policy. This can lead to a flurry of statements from officials in the days leading up to a blackout, followed by a sudden silence that leaves market participants guessing

Overall, the blackout policy can leave financial enthusiasts like me feeling frustrated and in the dark about the inner workings of the Federal Reserve. It’s a necessary evil to prevent premature market reactions but can often feel like an unnecessary hindrance to transparency and communication.

How the FOMC Blackout Policy Affects Me

As a retail investor, the FOMC blackout policy can have a significant impact on my investment decisions. The lack of communication from Federal Reserve officials during this period can create uncertainty in the markets, leading to increased volatility and potential losses. It’s important for me to be aware of this policy and adjust my investment strategy accordingly to mitigate any potential risks.

How the FOMC Blackout Policy Affects the World

The FOMC blackout policy not only affects individual investors like myself but also has broader implications for the global economy. The lack of communication from Federal Reserve officials during this period can create uncertainty in financial markets around the world, leading to increased volatility and potential disruptions. It’s important for policymakers and market participants to navigate this period with caution and consider the potential impact of the blackout policy on the broader economy.

In Conclusion

While the FOMC blackout policy may be necessary to prevent premature market reactions, it can often feel like an unnecessary hindrance to transparency and communication. As investors, it’s important for us to be aware of the implications of this policy and adjust our investment strategies accordingly. By staying informed and cautious during the blackout period, we can better navigate the uncertainty and volatility that comes with it.