Housing starts for March lower than expectations

What’s going on with the housing market?

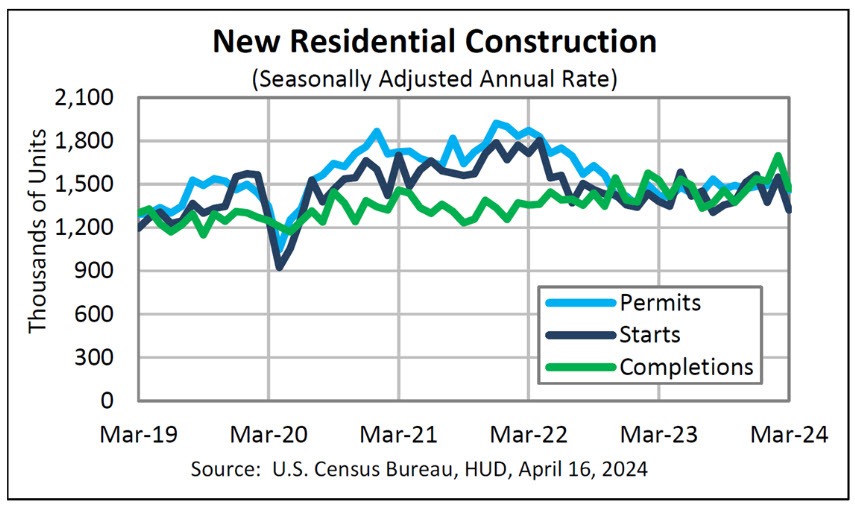

It looks like the housing market is facing some challenges as housing starts for March came in lower than expected. The previous month’s housing starts were revised up to 1.549M, but the latest data shows housing starts at 1.321M, which is below the estimated 1.487M. This marks a significant decrease of 14.7% compared to the previous month’s 10.7% increase.

Single-family vs multifamily housing starts

In March, single-family housing starts were at a rate of 1,022,000, representing a 12.4% decrease from the revised February figure of 1,167,000. On the other hand, multifamily housing starts in buildings with five units or more were at a rate of 290,000.

Implications for the housing market

The lower-than-expected housing starts for March could have various implications for the housing market. It could indicate a slowdown in new construction projects, potentially leading to a decrease in housing inventory. This could in turn impact home prices and affordability for potential buyers.

How will this affect me?

As a potential homebuyer or homeowner, the lower housing starts could impact you in a few ways. Reduced construction activity could result in fewer options for new homes, potentially leading to increased competition and higher prices in the housing market. This could make it more challenging to find a suitable home within your budget.

Global implications

The housing market plays a significant role in the global economy, so any disruptions or challenges in housing starts could have wider implications. A slowdown in construction activity could impact related industries such as real estate, construction, and finance. This could have ripple effects on the overall economic growth and stability of various countries around the world.

Conclusion

Overall, the lower-than-expected housing starts for March highlight some potential challenges in the housing market. It will be important to monitor how this trend evolves in the coming months and how it may impact both individuals and the global economy.