Euro Declines After ECB Opens Door for Rate Cuts, Dollar Eases Following PPI Data

The Euro Weakens After ECB Keeps Interest Rates Unchanged

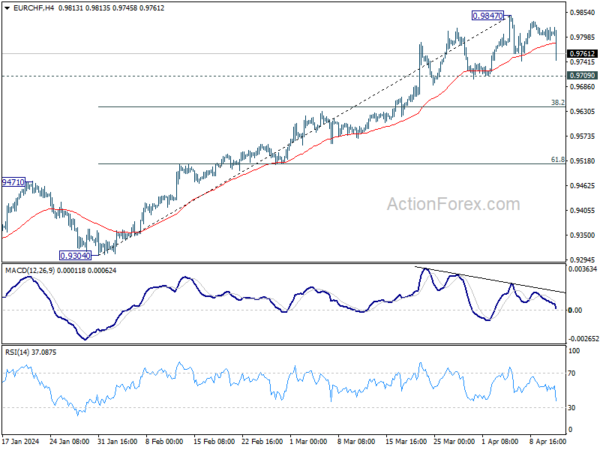

The Euro weakened broadly following the European Central Bank’s decision to maintain interest rates unchanged. This decline was further exacerbated by explicit suggestions of a potential rate cut in the near future. However, the selloff has been relatively mild compared to previous instances, primarily because the ECB’s statement didn’t serve as a definitive pre-announcement of rate cuts, unlike its guidance on rate hikes in 2022.

Moreover, the conditional guidance provided by the ECB regarding future rate adjustments has added to the uncertainty in the market, leading investors to reevaluate their positions and strategies.

Effect on Individuals:

As an individual, the Euro weakening against other major currencies may have a mixed impact on you. If you are planning a trip to Europe, you may find that your money doesn’t stretch as far as it used to, making your travel expenses higher. However, if you are an exporter selling goods to European countries, a weaker Euro could potentially make your products more competitive in those markets.

Effect on the World:

The Euro’s decline following the ECB’s decision could have ripple effects on the global economy. A weaker Euro may benefit countries that export to the Eurozone, as their products will become more affordable for European consumers. On the other hand, it could also lead to increased volatility in international markets as investors navigate the uncertainty surrounding the Euro’s future trajectory.

Conclusion

Overall, the Euro’s decline after the ECB’s decision to maintain interest rates unchanged highlights the interconnected nature of the global economy. As we continue to navigate these uncertain times, it is essential for individuals and businesses to stay informed and adapt to the ever-changing market conditions.