Welcome to Mike Dolan’s Market Insight

A Closer Look at the Day Ahead in U.S. and Global Markets

By Mike Dolan

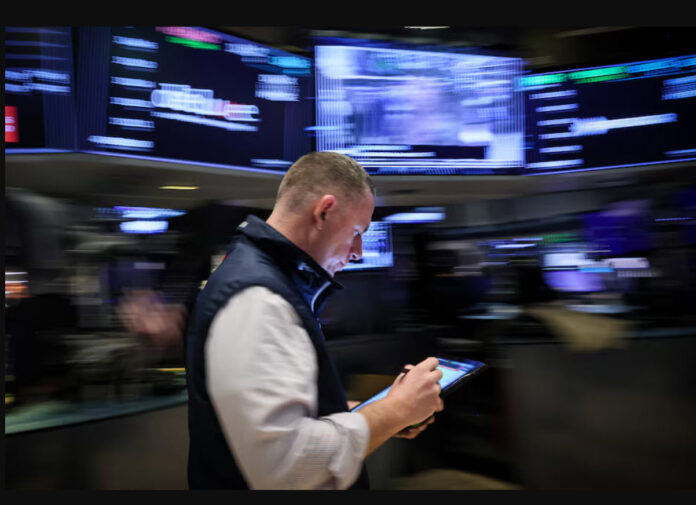

As we approach the end of the first quarter, all eyes are on Wall Street as it gears up for its final trading day. The Federal Reserve’s stance on interest rates has been a major point of discussion, with many wondering if a rate cut is on the horizon. However, Fed Governor Christopher Waller’s recent comments suggest that the central bank is in no rush to lower rates just yet. This has had a positive effect on the dollar, as other central banks around the world are eagerly waiting to make a move.

Waller’s statement on Wednesday was clear – the Fed is taking a patient approach when it comes to adjusting borrowing costs. This strategic decision has provided a sense of stability in the market, and investors are breathing a sigh of relief. While some may have hoped for a more aggressive stance from the Fed, Waller’s comments indicate that any rate adjustments will be made in a thoughtful and deliberate manner.

With the Easter break just around the corner, traders are cautiously optimistic about the road ahead. The first quarter has been a strong one for many, but uncertainties still linger. As we prepare to close out the quarter, it will be interesting to see how the market reacts to Waller’s comments and what implications they may have moving forward.

How Will This Affect Me?

For individual investors, Waller’s comments suggest that interest rates are likely to remain stable in the near future. This can be seen as a positive sign for those with investments tied to interest rates, as volatility in this area could impact returns. It’s always important to stay informed and keep a close eye on market developments to make informed decisions about your portfolio.

How Will This Affect the World?

The Fed’s decision to take a patient approach to interest rates could have a ripple effect across the global economy. As one of the world’s leading central banks, the Fed’s policies often influence the actions of other central banks. This steady approach could provide a sense of stability in the global marketplace, helping to quell fears of economic uncertainty.

Conclusion

As we navigate the final trading day of the first quarter, it’s clear that the Fed is taking a cautious approach when it comes to interest rates. While this may not be the news that some were hoping for, it does provide a sense of stability in the market. Investors should continue to monitor developments closely and make informed decisions based on the latest information available. Here’s to a successful end to the quarter and a promising start to the next.