Nikkei Takes Hit from Japan’s Vigorous Yen Verbal Intervention, But Yen’s Gain Lacks Strength: What Does This Mean?

What Happened?

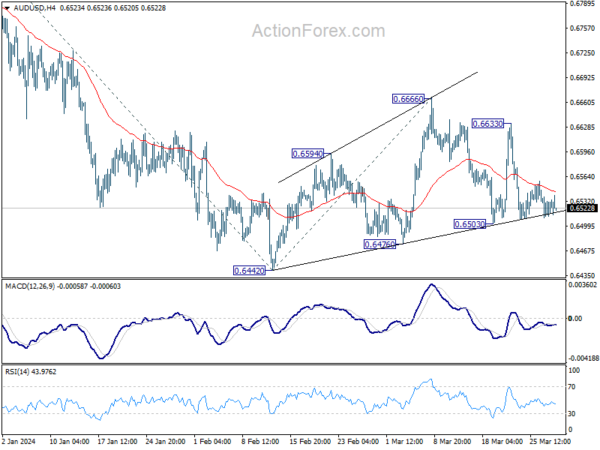

The Nikkei tumbled sharply in the Asian session today, largely in response to Yen’s rebound late yesterday. This rebound followed strong verbal interventions by Japanese officials aimed at curbing the currency’s recent weakness. Additionally, profit-taking activities could be another factor as markets gear up for an extended holiday weekend. The Yen’s rebound, while notable, has not yet demonstrated strong momentum.

What Does This Mean for Me?

As a retail investor, the impact of the Nikkei’s decline and Yen’s gain may not be immediately apparent. However, if you have investments tied to Japanese markets, you may see fluctuations in your portfolio value. It is always important to stay informed and consult with a financial advisor if you have concerns about your investments.

What Does This Mean for the World?

The Nikkei’s decline and the Yen’s gain could have broader implications for the global economy. Japan is a major player in the world economy, and any significant shifts in its financial markets can have ripple effects across other markets. Investors around the world will be watching closely to see how this situation unfolds.

Conclusion

While the Nikkei’s decline and the Yen’s gain may seem like short-term fluctuations, they are reflective of larger economic forces at play. It is important for both individual investors and global financial institutions to closely monitor these developments and be prepared to adapt to changing market conditions.