Are Rate Cuts on the Horizon? A Look at Morgan Stanley’s Predictions

What Morgan Stanley Predicts

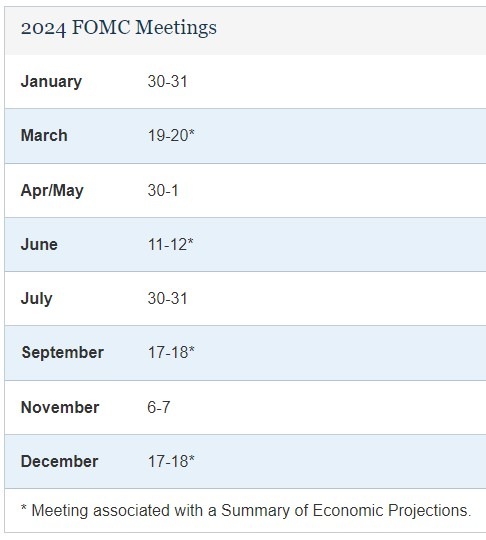

Analysts at Morgan Stanley expect the first rate cut from the US Federal Reserve at the June FOMC meeting. Followed by a cut in the meetings in September, November, and December. 25bp each time. Despite a higher long-run rate, the long-run growth projection was unchanged at 1.8%, indicating the Fed sees recent supply-side factors driving growth higher as temporary. Morgan Stanley also noted that “While large caps have exhibited declining rate sensitivity over the past few months, small caps’ correla…

How Will This Affect Me?

As an individual, rate cuts from the Federal Reserve can impact various aspects of your financial life. For example, lower interest rates can make it cheaper to borrow money for things like mortgages, auto loans, and credit cards. This can be beneficial for those looking to make big purchases or refinance existing debt. On the flip side, lower rates can mean lower returns on savings accounts and other interest-bearing investments. It’s important to stay informed and be proactive in adjusting your financial strategy accordingly.

How Will This Affect the World?

Rate cuts from the Federal Reserve can have far-reaching effects on the global economy. Lower interest rates in the US can impact foreign exchange rates, trade balances, and overall economic growth around the world. Countries with strong trade ties to the US may see changes in their own interest rates and currency values as a result of these cuts. Additionally, global financial markets may experience increased volatility as investors react to shifting monetary policies.

Conclusion

In conclusion, Morgan Stanley’s predictions for rate cuts from the US Federal Reserve signal potential changes ahead for both individuals and the global economy. It’s important to stay informed and flexible in your financial decisions as these developments unfold. Keep an eye on how these rate cuts may impact your own financial situation and be prepared to adjust your strategy accordingly.