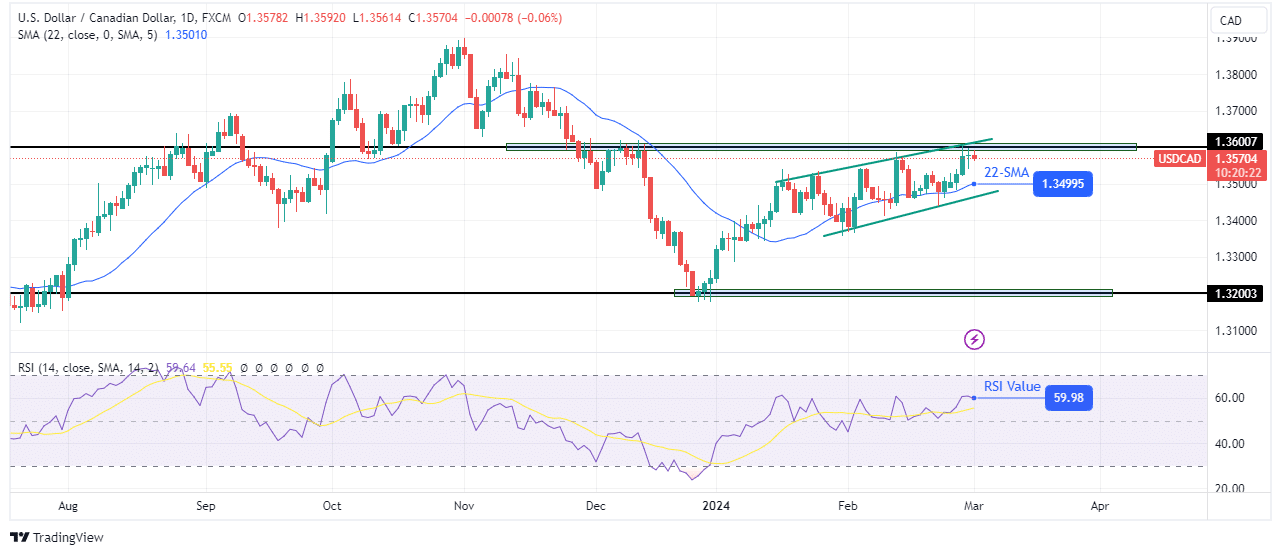

USD/CAD Weekly Forecast: Dollar Holds Strong Ahead of US NFP Report

Description

There was a bigger-than-expected build in crude inventories last week. GDP data from Canada showed a bigger-than-expected expansion in the fourth quarter. Market participants will watch the outcome of the Bank of Canada interest rate decision. The USD/CAD weekly forecast leans bullish as the dollar regains strength just in time for the highly anticipated nonfarm…

Blog Article

As we look ahead to the upcoming week, the USD/CAD forecast appears to be leaning towards a bullish trend. This is largely due to the resilience of the US dollar in the face of recent economic data releases and events affecting the Canadian economy.

One of the key factors influencing the USD/CAD outlook is the unexpected build in crude inventories last week. This increase in supply has put downward pressure on oil prices, which has historically had a negative impact on the Canadian dollar. As a result, the US dollar has strengthened as a safe haven currency in response to this development.

Additionally, recent GDP data from Canada has shown a larger-than-expected expansion in the fourth quarter. While this may seem like positive news for the Canadian economy, the overall impact on the USD/CAD exchange rate has been muted as the US dollar continues to hold its ground.

Looking ahead, market participants will be closely watching the outcome of the Bank of Canada’s interest rate decision. Any signals of a potential rate hike could further impact the USD/CAD forecast, potentially causing the dollar to weaken against the Canadian dollar.

Overall, the current outlook for the USD/CAD pair suggests a bullish trend, with the US dollar showing resilience ahead of the highly anticipated nonfarm payroll (NFP) report.

How this will affect me

As an individual investor or trader with exposure to the USD/CAD pair, the bullish forecast for the US dollar could potentially lead to profit opportunities if you are positioned long on the currency. It is important to stay informed of economic events and data releases that could impact the exchange rate and adjust your trading strategy accordingly.

How this will affect the world

The resilience of the US dollar against the Canadian dollar has broader implications for global markets and economies. A stronger US dollar could impact trade balances between the US and Canada, as well as other countries that trade with these two nations. Additionally, fluctuations in the USD/CAD pair can influence investor sentiment and market dynamics on a larger scale.

Conclusion

In conclusion, the USD/CAD weekly forecast suggests a bullish trend for the US dollar as it holds strong ahead of the US NFP report. It is important for individual traders and global market participants to stay informed of key economic events and data releases that could impact the exchange rate and adjust their strategies accordingly.