Exploring Japanese Inflation Trends

The Current State of Core Inflation in Japan

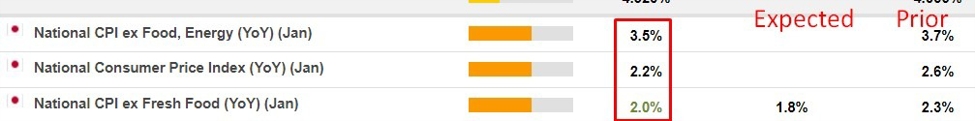

Japanese ‘core’ inflation, which excludes fresh food, was anticipated to drop below 2% for the first time since March 2022. While it hasn’t quite reached that level yet, it remains the slowest pace of increase since that time. The latest data shows that Japan’s CPI excluding fresh food and energy has increased by 3.5% year-on-year, which is the slowest rate of growth since February 2023. This was slightly higher than the expected 3.3% and lower than the previous reading of 3.7%. Additionally, the CPI excluding fresh food showed a year-on-year increase of 2.0%, marking the slowest growth since March 2022. The expected increase was 1.8%, compared to the prior reading of 2.3%. The headline CPI, which includes all items, rose by 2.2% year-on-year, surpassing the expected 1.9% but falling short of the previous figure of 2.6%.

The Impact of Inflation Rates

The slightly higher than expected rates of inflation will add fuel to the ongoing debate about the state of the Japanese economy and the effectiveness of monetary policy. While the slower pace of increase may offer some relief to consumers in the short term, it could also signal underlying economic challenges that need to be addressed.

How Will This Affect Me?

As an individual, the impact of these inflation trends may vary depending on your personal financial situation. A slower rate of inflation could mean that the cost of goods and services may not increase as quickly as expected, potentially providing some relief to your wallet. However, it could also indicate broader economic issues that may affect job security and overall financial stability.

Global Implications

Japan’s inflation trends can have ripple effects on the global economy, especially given its position as one of the world’s largest economies. Any slowdown in inflation could impact international trade and investment, as well as influence policy decisions by central banks around the world.

Conclusion

While Japanese inflation rates have not fallen as low as anticipated, the slower pace of increase suggests a delicate balance between economic growth and stability. As policymakers continue to monitor these trends, individuals and businesses alike must stay informed and adapt to the changing economic landscape.